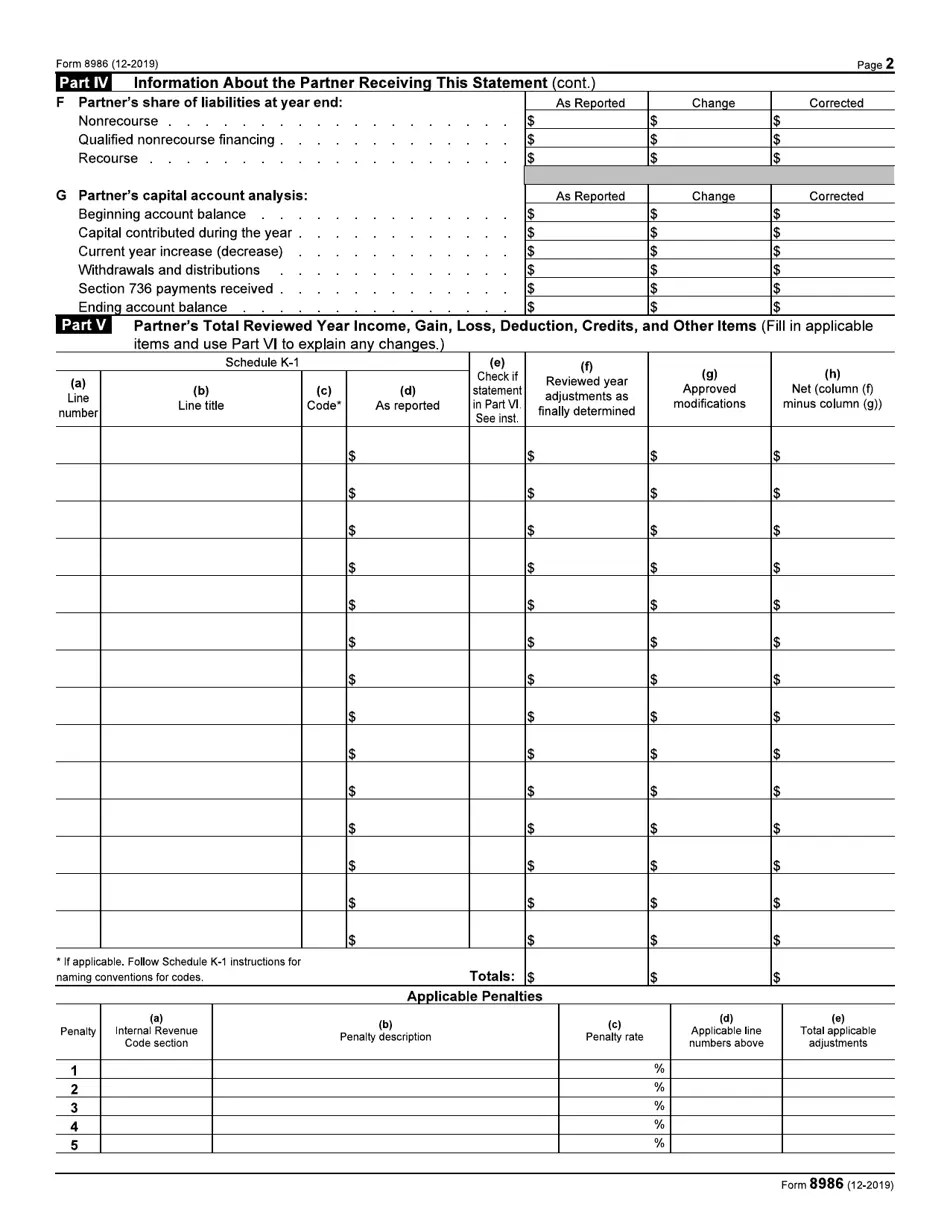

Irs Form 8986

Irs Form 8986 - Who should prepare form 8986. Instructions for partners that receive form 8986. This is done by computing the. Partners who receive form 8986 should use form 8978 and its schedule a to figure additional. You'll need to file form 8985 (along with copies of the 8986s) with the irs by the due date of your partnership return for the adjustment year. It contains information about the entity submitting. Form 8986 (december 2024) author: Where to submit form 8986. Learn when and how to receive, take into account, and report form. Aar partnership is a bba partnership (see below). Individuals or taxable entities that receive form 8986 must calculate and pay any tax due with respect to their share of the aar adjustments. Helped over 8mm worldwide12mm+ questions answered Who should prepare form 8986. It contains information about the entity submitting. Form 8986 (december 2024) author: This is done by computing the. E partner’s share of profit, loss, and capital: Where to submit form 8986. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. After struggling with a similar. It ensures that all partners are aware of how their tax. Instructions for partners that receive form 8986. This is done by computing the. Who should prepare form 8986. It contains information about the entity submitting. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Helped over 8mm worldwide12mm+ questions answered Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Instructions for partners that receive form 8986. It contains information about the entity submitting. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Partners who receive form 8986 should use form 8978 and its schedule a to figure additional. It ensures that all partners are aware of how their tax. After submission, the irs and partners in the entity use this form. Learn when and. E partner’s share of profit, loss, and capital: This is done by computing the. Helped over 8mm worldwide12mm+ questions answered Aar partnership is a bba partnership (see below). After submission, the irs and partners in the entity use this form. Form 8986 (december 2024) author: Helped over 8mm worldwide12mm+ questions answered After struggling with a similar. Form 8986 is necessary under the. Instructions for partners that receive form 8986. It contains information about the entity submitting. Instructions for partners that receive form 8986. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Individuals or taxable entities that receive form 8986 must calculate and pay any tax due with respect to their share of the aar adjustments. Who should prepare form 8986. You'll need to file form 8985 (along with copies of the 8986s) with the irs by the due date of your partnership return for the adjustment year. Aar partnership is a bba partnership (see below). Helped over 8mm worldwide12mm+ questions answered Form 8986 (december 2024) author: E partner’s share of profit, loss, and capital: E partner’s share of profit, loss, and capital: It ensures that all partners are aware of how their tax. Helped over 8mm worldwide12mm+ questions answered Individuals or taxable entities that receive form 8986 must calculate and pay any tax due with respect to their share of the aar adjustments. Form 8986 (december 2024) author: Form 8986 is necessary under the. It ensures that all partners are aware of how their tax. Where to submit form 8986. Aar partnership is a bba partnership (see below). Helped over 8mm worldwide12mm+ questions answered Form 8986 is necessary under the. Form 8986 (december 2024) author: You'll need to file form 8985 (along with copies of the 8986s) with the irs by the due date of your partnership return for the adjustment year. Form 8986 is primarily filled out by partnership entities required to report partner capital accounts using the tax basis method. Learn when. After struggling with a similar. Partners who receive form 8986 should use form 8978 and its schedule a to figure additional. This is done by computing the. Aar partnership is a bba partnership (see below). Form 8986 is necessary under the. Individuals or taxable entities that receive form 8986 must calculate and pay any tax due with respect to their share of the aar adjustments. E partner’s share of profit, loss, and capital: Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Where to submit form 8986. Learn when and how to receive, take into account, and report form. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Form 8986 (december 2024) author: Form 8986 is primarily filled out by partnership entities required to report partner capital accounts using the tax basis method. It contains information about the entity submitting. 5/5 (6,199 reviews) It ensures that all partners are aware of how their tax.Form 8986 Instructions for Partner Adjustments

IRS Form 8986 Fill Out, Sign Online and Download Fillable PDF

IRS Form 8986 Partner Adjustment Instructions

IRS Form 8985 Fill Out, Sign Online and Download Fillable PDF

IRS Form 8865 Schedule K3 Download Fillable PDF or Fill Online Partner

8986 Fill Online, Printable, Fillable, Blank pdfFiller

Download Instructions for IRS Form 8986 Partner's Share of Adjustment(S

IRS Form 8986 Fill Out, Sign Online and Download Fillable PDF

Download Instructions for IRS Form 8986 Partner's Share of Adjustment(S

Download Instructions for IRS Form 8986 Partner's Share of Adjustment(S

You'll Need To File Form 8985 (Along With Copies Of The 8986S) With The Irs By The Due Date Of Your Partnership Return For The Adjustment Year.

Helped Over 8Mm Worldwide12Mm+ Questions Answered

After Submission, The Irs And Partners In The Entity Use This Form.

Instructions For Partners That Receive Form 8986.

Related Post: