Is Form 5102 Legit

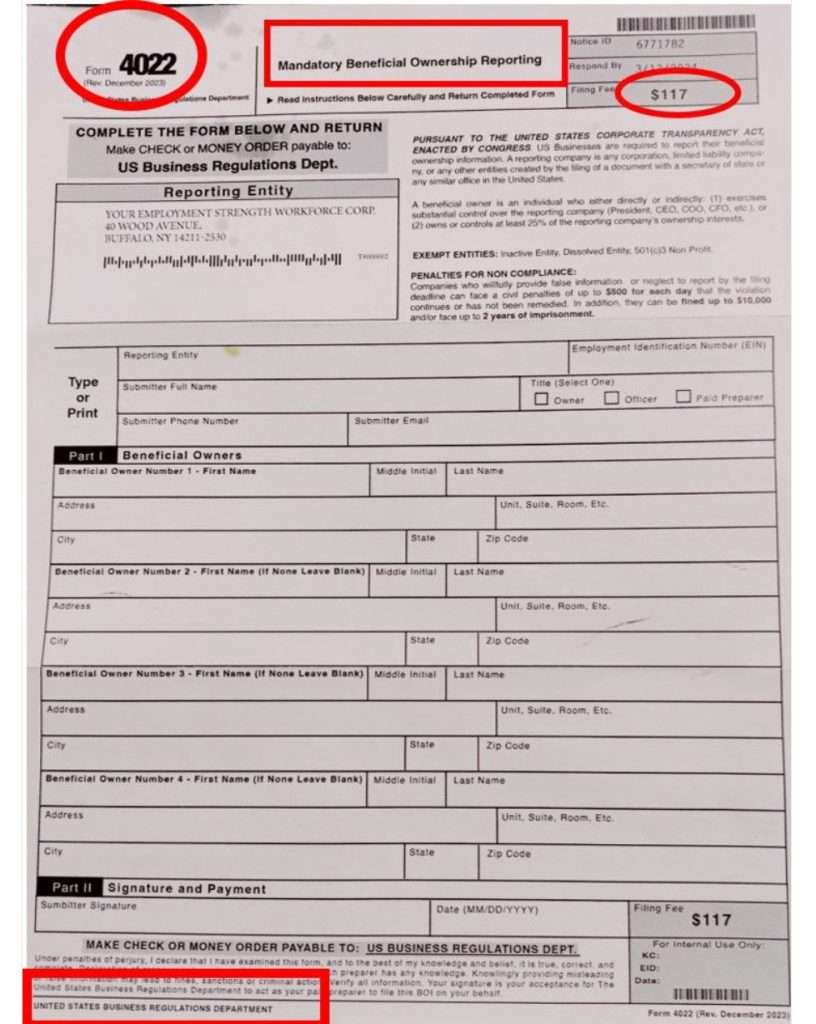

Is Form 5102 Legit - Reporting companies created before jan. Fincen does not have a “form 4022” or a “form 5102.” do not send your business. A form 5102 in the mail that. Examine and share scams with others to help protect you from existing schemes. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. Recently many businesses have received a fraudulent form 5102 requesting benefit ownership information and a filing fee. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Form 5102 boi form titled under annual records service with a filing fee of $119.00 due by 1/23/25 or penalties of $500 per day up to $10,000 and 2 years in prison if not. If your company was created between jan. Our oice is currently aware of three (3) boi filing scams: Correspondence that references a “form 4022” or “form 5102.”fincen does not have forms by those names. Our business received a government. Form 5102 boi form titled under annual records service with a filing fee of $119.00 due by 1/23/25 or penalties of $500 per day up to $10,000 and 2 years in prison if not. Reporting companies created before jan. This is a fraudulent form and should be. Fincen does not have a “form 4022” or a “form 5102.” do not send your business. Recently many businesses have received a fraudulent form 5102 requesting benefit ownership information and a filing fee. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Do not send boi to. Scammers are now capitalizing on the confusion surrounding boi reporting requirements. Recently many businesses have received a fraudulent form 5102 requesting benefit ownership information and a filing fee. Correspondence that references a “form 4022” or “form 5102.”fincen does not have forms by those names. These fraudulent scams may include: Form 5102 was received by physical. Examine and share scams with others to help protect you from existing schemes. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Correspondence that references a “form 4022” or “form 5102”. Taxpayers and tax professionals should be alert to fake communications posing as legitimate organizations in the tax and financial community, including the irs and the states. Government agencies and legitimate business. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Correspondence that references a “form 4022” or “form 5102”. If your company was created between jan. Form 5102 boi form titled under annual records service with a filing fee of $119.00 due by 1/23/25 or penalties of $500 per day. Reporting companies created before jan. Examine and share scams with others to help protect you from existing schemes. Our oice is currently aware of three (3) boi filing scams: Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Government agencies and legitimate business names and phone numbers are often. Form 5102 was received by physical. If your company was created between jan. Examine and share scams with others to help protect you from existing schemes. Form 5102 boi form titled under annual records service with a filing fee of $119.00 due by 1/23/25 or penalties of $500 per day up to $10,000 and 2 years in prison if not.. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Reporting companies created before jan. If your company was created between jan. Browse and view scams details reported to the bbb. A form 5102 in the mail that. Do not send boi to. Our business received a government. These fraudulent scams may include: Our oice is currently aware of three (3) boi filing scams: Taxpayers and tax professionals should be alert to fake communications posing as legitimate organizations in the tax and financial community, including the irs and the states. Reporting companies created before jan. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Do not send boi to. Form 5102 was received by physical. Examine and share scams with others to help protect you from existing schemes. Recently many businesses have received a fraudulent form 5102 requesting benefit ownership information and a filing fee. Reporting companies created before jan. Scammers are now capitalizing on the confusion surrounding boi reporting requirements. Fincen does not have a “form 4022” or a “form 5102.” do not send your business. A form 5102 in the mail that. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Form 5102 boi form titled under annual records service with a filing. Examine and share scams with others to help protect you from existing schemes. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. Form 5102 was received by physical. Recently many businesses have received a fraudulent form 5102 requesting benefit ownership information and a filing fee. These fraudulent scams may include: Scammers are now capitalizing on the confusion surrounding boi reporting requirements. Form 5102 boi form titled under annual records service with a filing fee of $119.00 due by 1/23/25 or penalties of $500 per day up to $10,000 and 2 years in prison if not. 1, 2024, must file their initial beneficial owner report no later than dec. Do not send boi to. Browse and view scams details reported to the bbb. A form 5102 in the mail that. Correspondence that references a “form 4022” or “form 5102.”fincen does not have forms by those names. This is a fraudulent form and should be. Taxpayers and tax professionals should be alert to fake communications posing as legitimate organizations in the tax and financial community, including the irs and the states. Government agencies and legitimate business names and phone numbers are often used by scam artists to take advantage of people. If your company was created between jan.Form 7345102 Fill Out, Sign Online and Download Printable PDF

Form 5102 Fill Out, Sign Online and Download Fillable PDF, Texas

Form 5102SBE Download Printable PDF or Fill Online Taxpayer Petition

CA DMV Form REG 5102. State Agency Sponsored Specialized License Plate

Form 4022 Scam Don't Fall Victim To This Bogus Tax Letter

New scam threat... bogus Home Warranty Letters HomesMSP Real Estate

Scam Alert BOI (Beneficial Ownership Information) Request Forms SJHL

OPNAVINST 5100.23G30 Dec

Texas C 5 Form ≡ Fill Out Printable PDF Forms Online

State Warns Businesses to Beware of Annual Report Assistance Scam that

Fincen Does Not Have A “Form 4022” Or A “Form 5102.” Do Not Send Your Business.

Reporting Companies Created Before Jan.

Government Agencies And Legitimate Business Names And Phone Numbers Are Often Used By Scam Artists To Take Advantage Of People.

Certain Types Of Corporations, Limited Liability Companies, And Other Similar Entities Created In Or Registered To Do Business In The United States Must Report Information About Their Beneficial.

Related Post: