K 1 Tax Form For Inheritance

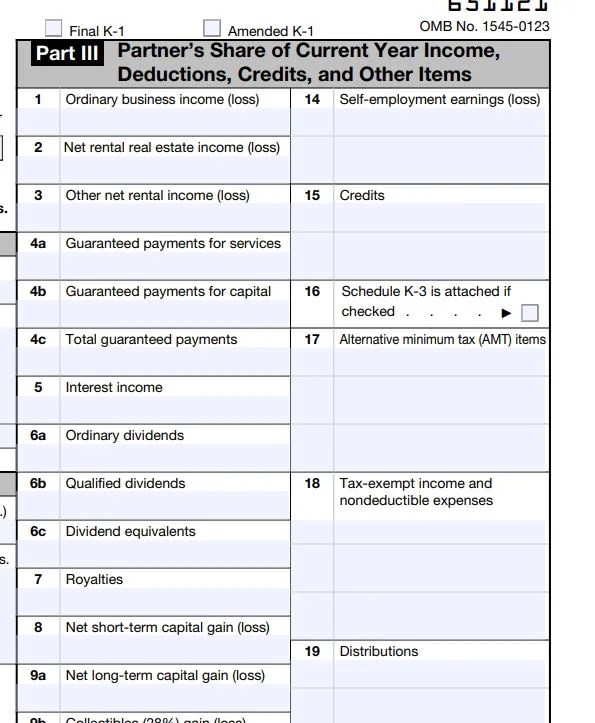

K 1 Tax Form For Inheritance - When a person passes away, his property is placed into an estate and undergoes probate, which is the legal process of dividing up the. Kentucky, maryland, nebraska, new jersey and pennsylvania. Generally, the personal representative (formerly executor) could provide you a statement. Keep it for your records. Instead, if the estate or trust you’re inheriting from has taxable income, the estate/trust will file. Illinois is set to eliminate its 1% grocery tax in january 2026. Money back guarantee paperless solutions cancel anytime fast, easy & secure The beneficiary must report this income on. File form 706 and pay the tax: No, you don’t have to pay taxes to the federal government on your. Illinois is set to eliminate its 1% grocery tax in january 2026. When a person passes away, his property is placed into an estate and undergoes probate, which is the legal process of dividing up the. If you are a beneficiary of an estate or trust,. Instead, if the estate or trust you’re inheriting from has taxable income, the estate/trust will file. Money back guarantee paperless solutions cancel anytime fast, easy & secure Kentucky, maryland, nebraska, new jersey and pennsylvania. No, you don’t have to pay taxes to the federal government on your. Don’t file it with your. As of 2025, only five states charge an inheritance tax: Don’t file it with your. No, you don’t have to pay taxes to the federal government on your. Illinois is set to eliminate its 1% grocery tax in january 2026. Kentucky, maryland, nebraska, new jersey and pennsylvania. If you don’t do this right, you’ll overpay or underpay—both of which may trigger a tax audit. File form 706 and pay the tax: If you don’t do this right, you’ll overpay or underpay—both of which may trigger a tax audit. If you are a beneficiary of an estate or trust,. Form 1041 is used to file an income tax return for estates and. Illinois is set to eliminate its 1% grocery tax in january 2026. As of 2025, only five states charge an. Kentucky, maryland, nebraska, new jersey and pennsylvania. Illinois is set to eliminate its 1% grocery tax in january 2026. Form 1041 is used to file an income tax return for estates and. Keep it for your records. Don’t file it with your. It’s the irs’s way of keeping tabs on the income and. As of 2025, only five states charge an inheritance tax: When a person passes away, his property is placed into an estate and undergoes probate, which is the legal process of dividing up the. If you don’t do this right, you’ll overpay or underpay—both of which may trigger a. Illinois is set to eliminate its 1% grocery tax in january 2026. The beneficiary must report this income on. Don’t file it with your. Keep it for your records. Money back guarantee paperless solutions cancel anytime fast, easy & secure File form 706 and pay the tax: Keep it for your records. The beneficiary must report this income on. When a person passes away, his property is placed into an estate and undergoes probate, which is the legal process of dividing up the. Don’t file it with your. If you don’t do this right, you’ll overpay or underpay—both of which may trigger a tax audit. As of 2025, only five states charge an inheritance tax: Illinois is set to eliminate its 1% grocery tax in january 2026. Form 1041 is used to file an income tax return for estates and. Generally, the personal representative (formerly executor) could provide. Instead, if the estate or trust you’re inheriting from has taxable income, the estate/trust will file. If you are a beneficiary of an estate or trust,. Keep it for your records. If you don’t do this right, you’ll overpay or underpay—both of which may trigger a tax audit. Generally, the personal representative (formerly executor) could provide you a statement. It’s the irs’s way of keeping tabs on the income and. As of 2025, only five states charge an inheritance tax: Generally, the personal representative (formerly executor) could provide you a statement. Instead, if the estate or trust you’re inheriting from has taxable income, the estate/trust will file. Keep it for your records. If you don’t do this right, you’ll overpay or underpay—both of which may trigger a tax audit. It’s the irs’s way of keeping tabs on the income and. Keep it for your records. Keep it for your records. No, you don’t have to pay taxes to the federal government on your. When a person passes away, his property is placed into an estate and undergoes probate, which is the legal process of dividing up the. Keep it for your records. No, you don’t have to pay taxes to the federal government on your. If you are a beneficiary of an estate or trust,. Money back guarantee paperless solutions cancel anytime fast, easy & secure Don’t file it with your. It’s the irs’s way of keeping tabs on the income and. If you don’t do this right, you’ll overpay or underpay—both of which may trigger a tax audit. Kentucky, maryland, nebraska, new jersey and pennsylvania. Form 1041 is used to file an income tax return for estates and. Don’t file it with your. Generally, the personal representative (formerly executor) could provide you a statement. Illinois is set to eliminate its 1% grocery tax in january 2026. As of 2025, only five states charge an inheritance tax:Schedule K1 Tax Form What Is It and Who Needs to Know?

Glen Birnbaum on Twitter "We have our first look at the 2023 DRAFT K1

20172025 Form IRS Schedule K1 (1065B) Fill Online, Printable

A Simple Guide to the Schedule K1 Tax Form Bench Accounting

2024 Schedule K1 Box 14 Code E F1 2024 Schedule

What Is a K1 Form What Is It Used For, When Is It Needed, and How to

K1 tax form for dummies mish mosh turned SIMPLE!

All About Schedule K1 Filling of Form 1065

IRS releases drafts of the new Form 1065, Schedule K1 Accounting Today

What Are Schedule K1 Documents Used For?

Instead, If The Estate Or Trust You’re Inheriting From Has Taxable Income, The Estate/Trust Will File.

Keep It For Your Records.

File Form 706 And Pay The Tax:

The Beneficiary Must Report This Income On.

Related Post:

:max_bytes(150000):strip_icc()/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)