K40 Tax Form

K40 Tax Form - Form 1041 is used to file an income tax return for estates and trusts with $600+ in gross income. Enter your personal and financial information, deductions, exemptions, and tax computation. Federal return information can then be transferred into mytax illinois, to free file illinois individual. Illinois department of revenue returns, schedules, and registration and related forms and instructions. 18.food sales tax credit (from line h,. Download and print the pdf form for filing your 2023 kansas income tax return. Forms about the office news and press videos. Ensure accurate reporting for your taxes. You must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total income.\r\nkansas law provides that if a husband or wife is a. Shade the box for negative amounts. You must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total income.\r\nkansas law provides that if a husband or wife is a. If you are not a resident of kansas but. Enter your personal and financial information, deductions, exemptions, and tax computation. File your kansas individual income tax return with form k40 (2023). Ensure accurate reporting for your taxes. These documents are in adobe acrobat portable document format (pdf). Eligible illinois taxpayers can file their 2024 federal returns directly with the irs for free. 18.food sales tax credit (from line h,. It captures all income sources and. Forms about the office news and press videos. Federal return information can then be transferred into mytax illinois, to free file illinois individual. Illinois department of revenue returns, schedules, and registration and related forms and instructions. The k40 form enables kansas residents to report state income taxes, calculating tax owed or refunds due based on income and deductions. Enter your personal and financial information, deductions, exemptions, and tax. The k40 form enables kansas residents to report state income taxes, calculating tax owed or refunds due based on income and deductions. If you are not a resident of kansas but. Forms about the office news and press videos. The instructions for form 1040 will guide you on where to report specific. It captures all income sources and. Enter your personal and financial information, deductions, exemptions, and tax computation. 18.food sales tax credit (from line h,. Choose the year, download the form, and follow the instructions. You must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total income.\r\nkansas law provides that if a husband or wife is. Ensure accurate reporting for your taxes. The kansas individual income tax return (form k40) is a document used by ks residents to report their taxable income and calculate any taxes owed or refunds due to the state of. Enter the result here and on line 18 of this form You must file a kansas individual income tax return to receive. These documents are in adobe acrobat portable document format (pdf). The instructions for form 1040 will guide you on where to report specific. Ensure accurate reporting for your taxes. Forms about the office news and press videos. Enter the result here and on line 18 of this form Form 1041 is used to file an income tax return for estates and trusts with $600+ in gross income. Ensure accurate reporting for your taxes. A broken property tax appeals system executive summary (para la versión en español, haga clic aquí) read the analysis (para la. The instructions for form 1040 will guide you on where to report specific. Forms. The k40 form enables kansas residents to report state income taxes, calculating tax owed or refunds due based on income and deductions. You must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total income.\r\nkansas law provides that if a husband or wife is a. Food sales tax credit (multiply. Download, fill, and submit online. Shade the box for negative amounts. This form is used to. Eligible illinois taxpayers can file their 2024 federal returns directly with the irs for free. Federal return information can then be transferred into mytax illinois, to free file illinois individual. Food sales tax credit (multiply line g by $125). The k40 form enables kansas residents to report state income taxes, calculating tax owed or refunds due based on income and deductions. Enclose any necessary documents with this form. Form 1041 is used to file an income tax return for estates and trusts with $600+ in gross income. This form is. A broken property tax appeals system executive summary (para la versión en español, haga clic aquí) read the analysis (para la. To file, you will complete the interview questions as they pertain to you. If you are not a resident of kansas but. Amended returns must be filed within three years of when the. Form 1041 is used to file. You must file a kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total income.\r\nkansas law provides that if a husband or wife is a. A broken property tax appeals system executive summary (para la versión en español, haga clic aquí) read the analysis (para la. 18.food sales tax credit (from line h,. File your kansas individual income tax return with form k40 (2023). Enter the result here and on line 18 of this form Food sales tax credit (multiply line g by $125). The kansas individual income tax return (form k40) is a document used by ks residents to report their taxable income and calculate any taxes owed or refunds due to the state of. Download, fill, and submit online. Ensure accurate reporting for your taxes. Form 1041 is used to file an income tax return for estates and trusts with $600+ in gross income. Forms about the office news and press videos. To file, you will complete the interview questions as they pertain to you. Amended returns must be filed within three years of when the. If you are not a resident of kansas but. These documents are in adobe acrobat portable document format (pdf). Federal return information can then be transferred into mytax illinois, to free file illinois individual.Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

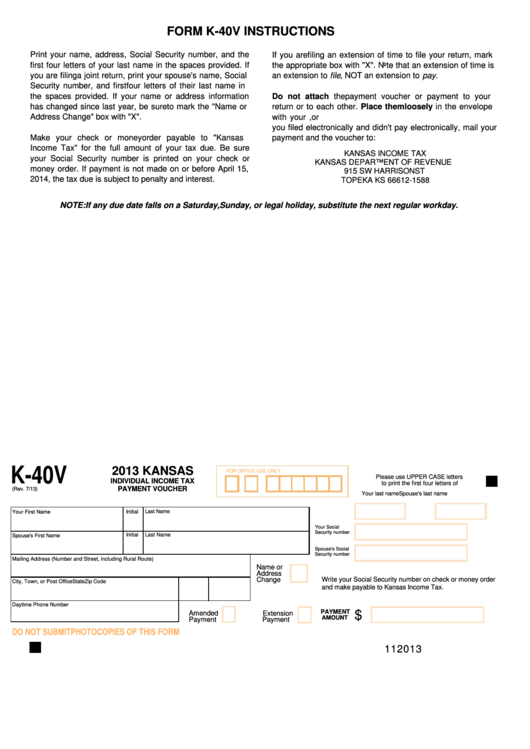

Fillable Form K40v Kansas Individual Tax Payment Voucher

Form k 40 Fill out & sign online DocHub

Form K40ES Download Fillable PDF or Fill Online Kansas Individual

Kansas Form K 4 ≡ Fill Out Printable PDF Forms Online

Kansas Individual Tax Form K40 Instructions

Kansas K 40 Form ≡ Fill Out Printable PDF Forms Online

KANSAS TAX FORM K40 and Schedule S. ppt download

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

This Form Is Used To.

The Instructions For Form 1040 Will Guide You On Where To Report Specific.

Download And Print The Pdf Form For Filing Your 2023 Kansas Income Tax Return.

The K40 Form Enables Kansas Residents To Report State Income Taxes, Calculating Tax Owed Or Refunds Due Based On Income And Deductions.

Related Post: