Maryland Form 502Cr

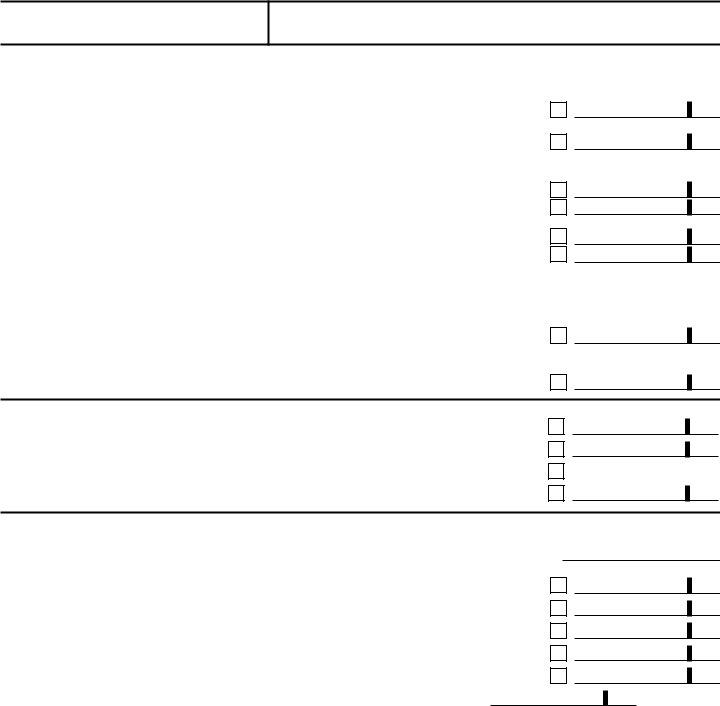

Maryland Form 502Cr - Compute the maryland tax that would be due on the revised taxable net income by using the maryland tax table or computation worksheet contained in the instructions for forms 502 or. Enter the maryland tax from line 21, form 502 (or line 11, form 504). You may report the following tax credits on this form: For complete filing instructions for the maryland return and the reciprocal state, click here. Form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). Read instructions for form 502cr. The credit is claimed on the maryland. To claim a credit for taxes paid to the other state, and/or local. Or line 11, form 504). Download or print the 2024 maryland form 502cr to claim various tax credits for individuals. To claim a credit for taxes paid to the other state, and/or local. Maryland’s 502cr tax credit offers residents. This is the maryland tax based. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). Or line 11, form 504). Enter the maryland tax (sum of lines 21 and 21a, form 502; This is the maryland tax based on your total income for the year. Learn eligibility, calculation, and filing tips for optimal tax benefits. The credit is claimed on the maryland. You may report the following tax credits on this form: Enter the maryland tax (sum of lines 21 and 21a, form 502; Enter the maryland tax from line 21, form 502 (or line 11, form 504). To claim a credit for taxes paid to the other state, and/or local. This is the maryland tax based on your. Or line 11, form 504). Navigate the 502cr tax credit on your maryland return with ease. Enter the maryland tax from line 21, form 502 (or line 11, form 504). This is the maryland tax based. Maryland’s 502cr tax credit offers residents. This is the maryland tax based on your total income for the year. You must file your maryland income tax return on form 502 and complete lines 1 through 21 and line 28 of that form, or on form 504 and complete lines 1 through 11 and line 18. Navigate the 502cr tax credit on your maryland return with ease.. For complete filing instructions for the maryland return and the reciprocal state, click here. Form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). Maryland’s 502cr tax credit offers residents. A maryland resident having income from one of these states must report the income on the maryland return form 502. Or line 11, form 504). This is the maryland tax based on your. Enter the maryland tax (sum of lines 21 and 21a, form 502; Read instructions for form 502cr. You may report the following tax credits on this form: For complete filing instructions for the maryland return and the reciprocal state, click here. Enter the maryland tax (sum of lines 21 and 21a, form 502; The credit is claimed on the maryland. On your total income for the year. A maryland resident having income from one of these states must report the income on the maryland return form 502. Navigate the 502cr tax credit on your maryland return with ease. To claim a credit for taxes paid to the other state, and/or local. This is the maryland tax based on your total income for the year. Total income for the year. Form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). Read instructions for form 502cr. You may report the following tax credits on this form: A resident taxpayer is entitled to claim a credit for income tax paid to another state if the income is subject to tax in both maryland and another jurisdiction. For more information about this credit please see the maryland form 502cr instructions here. Or line 11, form 504). You must. For more information about this credit please see the maryland form 502cr instructions here. For complete filing instructions for the maryland return and the reciprocal state, click here. Read instructions for form 502cr. The credit is claimed on the maryland. Learn eligibility, calculation, and filing tips for optimal tax benefits. Download or print the 2024 maryland form 502cr to claim various tax credits for individuals. For complete filing instructions for the maryland return and the reciprocal state, click here. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Navigate the 502cr tax credit on your maryland return with ease. Enter. Form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). You must complete and submit pages 1 through 4 of this form to receive credit for the items listed. To claim a credit for taxes paid to the other state, and/or local. Total income for the year. Or line 11, form 504). A resident taxpayer is entitled to claim a credit for income tax paid to another state if the income is subject to tax in both maryland and another jurisdiction. The credit is claimed on the maryland. This is the maryland tax based. Learn eligibility, calculation, and filing tips for optimal tax benefits. Read instructions for form 502cr. You must file your maryland income tax return on form 502 and complete lines 1 through 21 and line 28 of that form, or on form 504 and complete lines 1 through 11 and line 18. Or line 11, form 504). A maryland resident having income from one of these states must report the income on the maryland return form 502. This is the maryland tax based on your. Enter the maryland tax from line 21, form 502 (or line 11, form 504). Read instructions for form 502cr.Fillable Online Maryland Form 502CR (Maryland Personal Tax

Fillable Maryland Form 502 Resident Tax Return 2015

Fillable Maryland Form 502cr Tax Credits For Individuals

Fillable Online Maryland Form 502CR Tax Credits for Individuals

502CR Maryland Tax Forms and Instructions

Maryland Form 502 Download Fillable PDF or Fill Online

Form 502cr Personal Tax Credits For Individuals 2000

Fillable Online Maryland Tax Forms 2021 Printable State MD Form 502

Maryland Form 502Cr ≡ Fill Out Printable PDF Forms Online

502CR Maryland Tax Forms and Instructions

For Complete Filing Instructions For The Maryland Return And The Reciprocal State, Click Here.

Compute The Maryland Tax That Would Be Due On The Revised Taxable Net Income By Using The Maryland Tax Table Or Computation Worksheet Contained In The Instructions For Forms 502 Or.

Navigate The 502Cr Tax Credit On Your Maryland Return With Ease.

Enter The Maryland Tax (Sum Of Lines 21 And 21A, Form 502;

Related Post: