Nj Extension Form

Nj Extension Form - The application for extension of time to file a new jersey gross income tax return (form nj. Find and download forms for resident, nonresident, fiduciary, and composite. The application for extension of time to file a new jersey gross income tax return (form nj. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. Pay income taxes only by credit or. You only need to file a nj tax extension if you owe new jersey. The new jersey tax portal will give taxpayers and. Learn how to apply for an extension of time to file your new jersey income tax return until. Learn how to file a new jersey tax extension by mail or online, and what forms and. To be eligible for an extension, you must have paid by the original due date of your return,. The new jersey tax portal will give taxpayers and. Learn how to file a new jersey tax extension by mail or online, and what forms and. Welcome to the new jersey tax portal. Download and complete this form to request an extension of time to file an inheritance tax. Learn how to apply for an extension of time to file your new jersey income tax return until. To be eligible for an extension, you must have paid by the original due date of your return,. A form 4868 also allows you to file for an extension, and can be done either. Find and download forms for resident, nonresident, fiduciary, and composite. File for an extension of a deadline for income tax filings. You only need to file a nj tax extension if you owe new jersey. The application for extension of time to file a new jersey gross income tax return (form nj. Learn how to file a new jersey tax extension by mail or online, and what forms and. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. Find and download forms for resident, nonresident, fiduciary,. New jersey tax extension quick facts: Learn how to file a new jersey tax extension by mail or online, and what forms and. Learn how to file a new jersey tax extension, understand eligibility, required. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. To be eligible for an extension, you. The application for extension of time to file a new jersey gross income tax return (form nj. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. The application for extension of time to file a new jersey gross income tax return (form nj. Download and complete this form to request an. The application for extension of time to file a new jersey gross income tax return (form nj. The application for extension of time to file a new jersey gross income tax return (form nj. Learn how to efficiently file an nj tax extension, understand eligibility, required. If you are filing a federal extension, you will need to include a copy. Pay income taxes only by credit or. New jersey tax extension quick facts: To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. You only need to file a nj tax extension if you owe new jersey. The new jersey tax portal will give taxpayers and. Learn how to file a new jersey tax extension, understand eligibility, required. File for an extension of a deadline for income tax filings. Learn how to apply for an extension of time to file your new jersey income tax return until. Download and complete this form to request an extension of time to file an inheritance tax. If you are. Welcome to the new jersey tax portal. The application for extension of time to file a new jersey gross income tax return (form nj. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. You only need to file a nj tax extension if you owe new jersey. Learn how to file. What form does the state of new jersey require to apply for an extension? New jersey tax extension quick facts: A form 4868 also allows you to file for an extension, and can be done either. Pay income taxes only by credit or. Welcome to the new jersey tax portal. File for an extension of a deadline for income tax filings. Learn how to file a new jersey tax extension, understand eligibility, required. What form does the state of new jersey require to apply for an extension? The application for extension of time to file a new jersey gross income tax return (form nj. New jersey tax extension quick facts: If you are filing a federal extension, you will need to include a copy of that. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. Learn how to file a new jersey tax extension by mail or online, and what forms and. A form 4868 also allows you to file for. Welcome to the new jersey tax portal. Pay income taxes only by credit or. Learn how to file a new jersey tax extension, understand eligibility, required. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated. The new jersey tax portal will give taxpayers and. Find and download forms for resident, nonresident, fiduciary, and composite. You only need to file a nj tax extension if you owe new jersey. A form 4868 also allows you to file for an extension, and can be done either. What form does the state of new jersey require to apply for an extension? 6 months for individual returns (forms. The application for extension of time to file a new jersey gross income tax return (form nj. If you are filing a federal extension, you will need to include a copy of that. Learn how to efficiently file an nj tax extension, understand eligibility, required. To be eligible for an extension, you must have paid by the original due date of your return,. New jersey tax extension quick facts: The application for extension of time to file a new jersey gross income tax return (form nj.Fillable Form Nj630 Application For Extension Of Time To File New

Fillable Form ItExt Inheritance And Estate Tax Application For

NJ Return to Work, PT/Temp and EB question (collect, extension, file

Form Cbt200T Tentative Return And Application For Extension Of Time

P30 form nj Fill out & sign online DocHub

Nj tax extension form Fill out & sign online DocHub

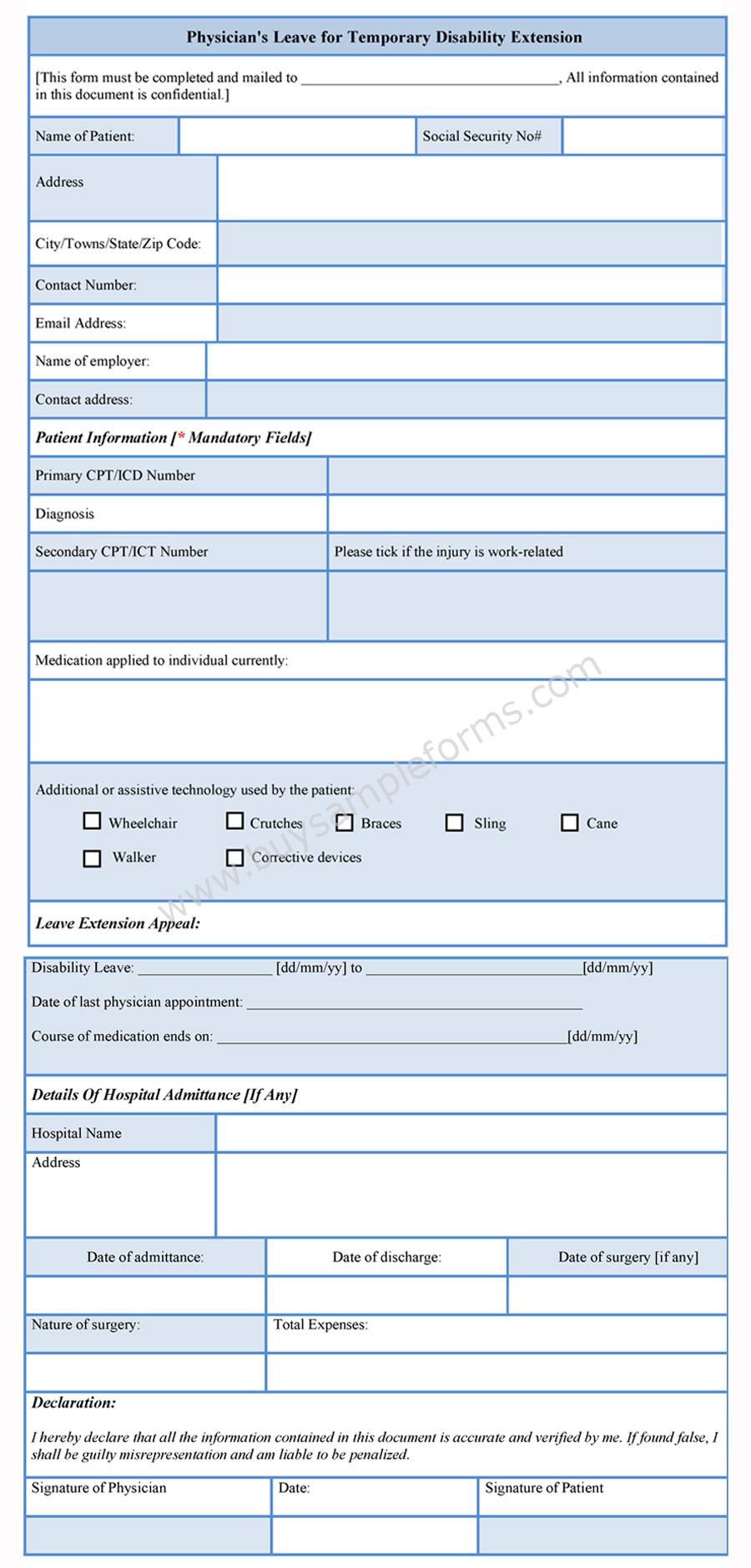

FREE 23+ Sample Disability Forms in PDF Word Excel

Form NJ630M Download Fillable PDF or Fill Online Application for

Disability Extension Form

How to File a New Jersey State Tax Extension Filing Info & Forms

File For An Extension Of A Deadline For Income Tax Filings.

Learn How To File A New Jersey Tax Extension By Mail Or Online, And What Forms And.

Download And Complete This Form To Request An Extension Of Time To File An Inheritance Tax.

Learn How To Apply For An Extension Of Time To File Your New Jersey Income Tax Return Until.

Related Post: