Ohio State Tax Withholding Form

Ohio State Tax Withholding Form - Ohio’s state income tax system features three tax brackets, with rates ranging from 0% to 3.5% for the 2024 tax year (the taxes you’ll file in 2025). Access the forms you need to file taxes or do business in ohio. This form allows ohio employees to claim income tax withholding. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. The ohio department of taxation provides a searchable repository of individual tax forms for multiple. This updated form, or an electronic equivalent, should be used by new hires or. Please review the 1099 specifications on. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. Your ohio state tax withholding selection will remain in force until you change or cancel it by submitting a new ohio state tax withholding form. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. The ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your You must determine the amount per month you want withheld from your. The ohio it 4 form is an employee’s withholding exemption certificate that allows employees in ohio to declare their exemption status from state income tax withholding. Need 10 or more ohio tax forms?. This updated form, or an electronic equivalent, should be used by new hires or. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. Estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. Use tax finder , to complete the municipality name/tax code and. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by. This updated form, or an electronic equivalent, should be used by new hires or. Employee's withholding exemption certificate submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Your ohio state tax withholding selection will remain in force until you change or cancel. This updated form, or an electronic equivalent, should be used by new hires or. Ohio’s state income tax system features three tax brackets, with rates ranging from 0% to 3.5% for the 2024 tax year (the taxes you’ll file in 2025). Please review the 1099 specifications on. Your tax rate depends on your. Ohio form it 4, employee’s withholding exemption. Your ohio state tax withholding selection will remain in force until you change or cancel it by submitting a new ohio state tax withholding form. Complete this form if you wish to have state of ohio income tax withheld from your monthly benefit payment. This form allows ohio employees to claim income tax withholding. You must determine the amount per. This form allows ohio employees to claim income tax withholding. Official state of iowa website. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. Download or print the 2024 ohio (employee's withholding exemption certificate) (2024) and other income tax forms from the ohio department of taxation. The ohio department of taxation. Ohio’s state income tax system features three tax brackets, with rates ranging from 0% to 3.5% for the 2024 tax year (the taxes you’ll file in 2025). Use tax finder , to complete the municipality name/tax code and. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a. This form allows ohio employees to claim income tax withholding. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding. Your ohio state tax withholding selection will remain in force until you change or cancel it by submitting a new ohio state tax withholding form. This result may occur because the tax on their combined income will be greater than. The ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to. Estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. This result may occur because the tax on their combined income will be greater than. Please review the 1099 specifications on. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. Ohio’s state income tax. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your Employee's withholding exemption certificate submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your.. With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees' pay. Complete this form if you wish to have state of ohio income tax withheld from your monthly benefit payment. The ohio it 4 form is an employee’s withholding exemption certificate that allows employees in ohio to declare their exemption status from state income tax withholding. This updated form, or an electronic equivalent, should be used by new hires or. The ohio department of taxation provides a searchable repository of individual tax forms for multiple. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a. Please review the 1099 specifications on. Ohio’s state income tax system features three tax brackets, with rates ranging from 0% to 3.5% for the 2024 tax year (the taxes you’ll file in 2025). Access the forms you need to file taxes or do business in ohio. This form allows ohio employees to claim income tax withholding. Employee's withholding exemption certificate submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Official state of iowa website. Need 10 or more ohio tax forms?. Estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect yourOhio Employer Withholding Tax printable pdf download

Ohio State Tax Withholding Form 2023 Printable Forms Free Online

Nys Withholding Form Employee

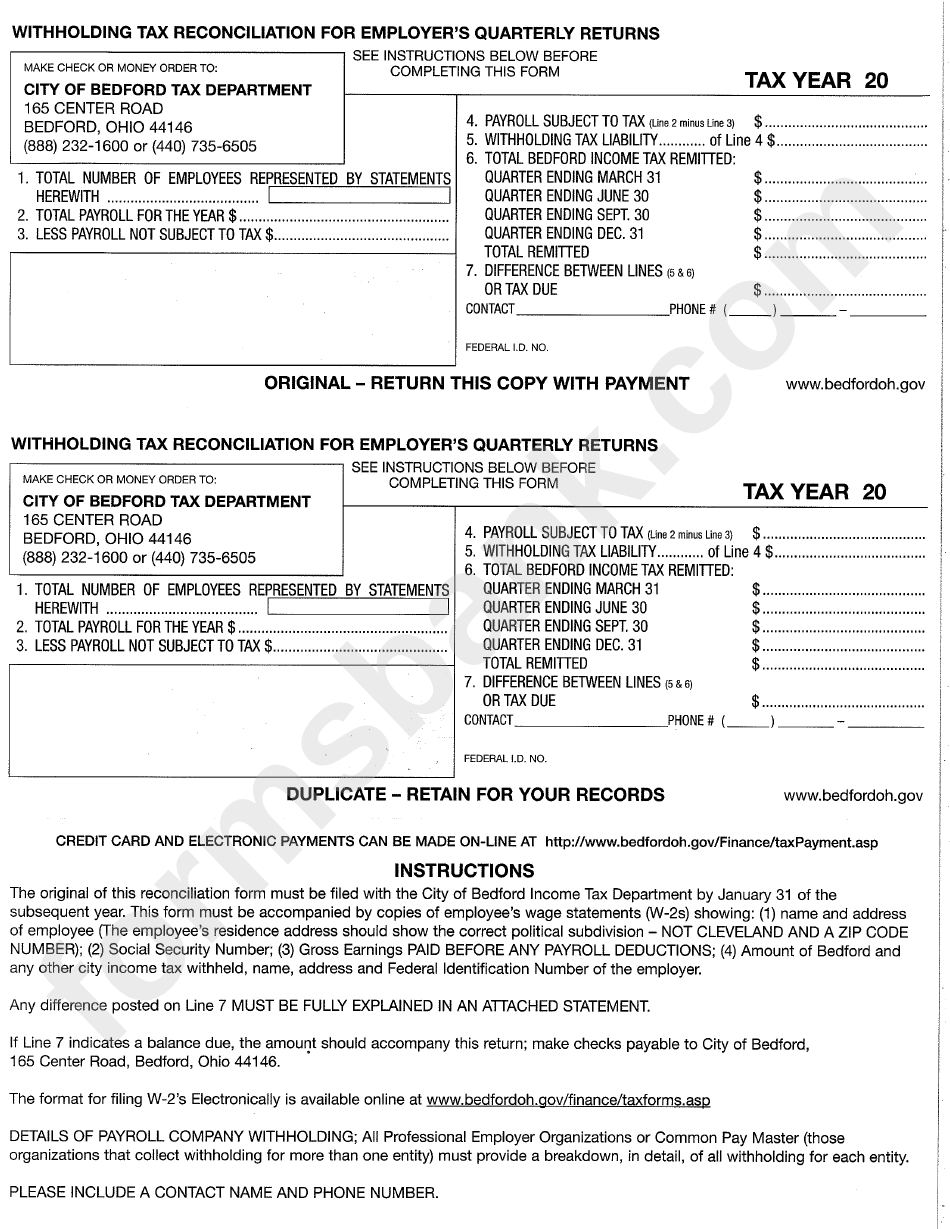

Withholding Tax Reconciliation For Employer'S Querterly Returns Form

Ohio State Withholding Form 2021 2022 W4 Form

Ashtabula Ohio Tax Withholding Forms

Ohio State Tax Withholding Form 2025 Aundrea S. Slaven

W4 Form 2023 Printable Employee's Withholding Certificate

Ohio Tax Withholding Form 2024 Cal Annabelle

Fillable Online opf withholding certificate for ohio state tax

Your Ohio State Tax Withholding Selection Will Remain In Force Until You Change Or Cancel It By Submitting A New Ohio State Tax Withholding Form.

Municipal Income Tax Withholding Form From The Hub, Go To Divisions, Finance, Payroll, Forms To Access This Form.

The Department Of Taxation Recently Revised Form It 4, Employee’s Withholding Exemption Certificate.

Your Tax Rate Depends On Your.

Related Post: