Ohio State Withholding Form

Ohio State Withholding Form - Personal information employee name* employee ssn* address, city, state, zip code* school district of. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. This updated form, or an electronic equivalent, should be used by new hires or. Employee's withholding exemption certificate emit ohio income tax from your compensation. The employee uses the ohio it 4 to determine the number of exemptions that the employee is. Several of our employees are ohio residents that commute to our indiana business location each work day. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Ohio employers also have the responsibility. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax. Should we withhold ohio income tax on those employees' compensation? Or under an agreement with your employer, you may have an additional. Use tax finder, to complete the municipality name/tax code and. Such employee should check the appropriate. The employer is required to have each employee that works in ohio to complete this form. The form lets you know. The it 4 is a combined document inclusive of the it 4, it. If you live or work in ohio, you may need to complete an ohio form it 4. Employee's withholding exemption certificate emit ohio income tax from your compensation. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. Most forms are available for download and some can be filled or. The it 4 is a combined document inclusive of the it 4, it. If you live or work in ohio, you may need to complete an ohio form it 4. Download or print the 2024 ohio (employee's withholding exemption certificate) (2024) and other income tax forms from the. With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees' pay. Such employee should check the appropriate. Personal information employee name* employee ssn* address, city, state, zip code* school district of. This updated form, or an electronic equivalent, should be used by new hires or. Download or print the 2024. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money. Employee's withholding exemption certificate emit ohio income tax from your compensation. Your employer may require you to complete this form electronically. Most forms are available for download and some can be filled or. If you live or work in. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. The form lets you know. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money. Ohio employers also have the responsibility. Employee's withholding exemption certificate emit ohio income tax from your compensation. If applicable, your employer w ll also withhold school district income tax. The form lets you know. Employee's withholding exemption certificate emit ohio income tax from your compensation. Should we withhold ohio income tax on those employees' compensation? The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. This updated form, or an electronic equivalent, should be used by new hires or. If applicable, your employer w ll also withhold school district income tax. If you expect to owe more ohio income tax than will be withheld, you may claim. If you expect to owe more ohio income tax than will be withheld, you may claim a smaller number of exemptions; Need paper individual or school district income tax forms mailed to you? Should we withhold ohio income tax on those employees' compensation? With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax. The employer is required to have each employee that works in ohio to complete this form. Your ohio state tax withholding selection will remain in force until you change or cancel it by submitting a new ohio state tax withholding form. Download or print the 2024 ohio (employee's withholding exemption certificate) (2024) and other income tax forms from the ohio. Municipal income tax withholding form from the hub, go to divisions, finance, payroll, forms to access this form. Several of our employees are ohio residents that commute to our indiana business location each work day. Such employee should check the appropriate. This section is for individuals whose income is deductible or excludable from ohio income tax, and thus employer withholding. Such employee should check the appropriate. If you expect to owe more ohio income tax than will be withheld, you may claim a smaller number of exemptions; Or under an agreement with your employer, you may have an additional. Need paper individual or school district income tax forms mailed to you? Learn about this form and how to fill it. Should we withhold ohio income tax on those employees' compensation? Several of our employees are ohio residents that commute to our indiana business location each work day. Your employer may require you to complete this form electronically. Personal information employee name* employee ssn* address, city, state, zip code* school district of. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Or under an agreement with your employer, you may have an additional. Download or print the 2024 ohio (employee's withholding exemption certificate) (2024) and other income tax forms from the ohio department of taxation. If you expect to owe more ohio income tax than will be withheld, you may claim a smaller number of exemptions; Use tax finder, to complete the municipality name/tax code and. The form lets you know. This section is for individuals whose income is deductible or excludable from ohio income tax, and thus employer withholding is not required. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money. The employer is required to have each employee that works in ohio to complete this form. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax. Such employee should check the appropriate.Fillable Online opf withholding certificate for ohio state tax

Ohio State Tax Forms Printable

Employee Dc Tax Withholding Form 2022

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Ohio State Tax Withholding Form 2023 Printable Forms Free Online

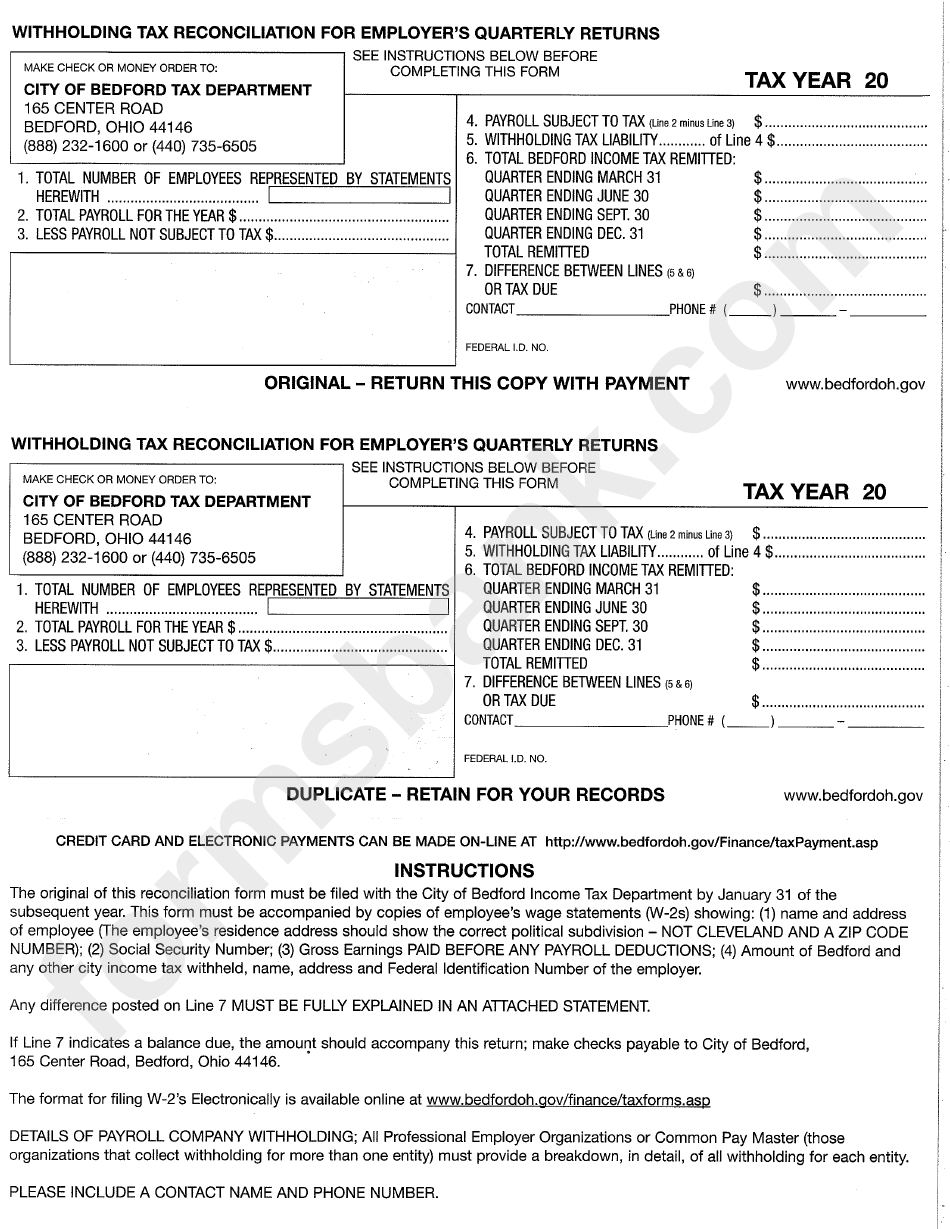

Withholding Tax Reconciliation For Employer'S Querterly Returns Form

Withholding Questionnaire Form State Of Ohio printable pdf download

Form IT4 Download Fillable PDF or Fill Online Employee's Withholding

Fillable Form It4 Employee'S Withholding Exemption Certificate

Form 89 350 14 8 1 000 Mississippi Employee S Withholding Certificate

Your Ohio State Tax Withholding Selection Will Remain In Force Until You Change Or Cancel It By Submitting A New Ohio State Tax Withholding Form.

The Employee Uses The Ohio It 4 To Determine The Number Of Exemptions That The Employee Is.

With Rare Exception, Employers That Do Business In Ohio Are Responsible For Withholding Ohio Individual Income Tax From Their Employees' Pay.

If Applicable, Your Employer W Ll Also Withhold School District Income Tax.

Related Post: