Oregon Oq Form

Oregon Oq Form - •keep copies of form oq, schedule b, form 132, and form or‑otc for your records. Beginning with the third quarter 2022, oregon employers will use the frances online website to upload and complete your quarterly filing. We don't recommend using your web browser to complete the form, as. Combined payroll tax reports form oq. Employers will report subject employee wages, contributions based on those wages, and employer contributions on a revised quarterly employer tax report (form oq). • report whole hours on form oq (wbf assess‑ ment) and on form 132. How do i file quarterly taxes in oregon? Combined payroll tax reports form oq. Download and save the form to your computer, then open it in adobe reader to complete and print. Put the bin and quarter/year on each report. Beginning with the third quarter 2022, oregon employers will use the frances online website to upload and complete your quarterly filing. We don't recommend using your web browser to complete the form, as. Choose a quarterly report filing method: Blank forms are available online or by order. Use only to report quarters with no payroll or no hours worked. Use the correct oregon business identification • report whole hours on form oq (wbf assessment) number (bin). Put the bin and quarter/year on each report. Download and save the form to your computer, then open it in adobe reader to complete and print. Employers will report subject employee wages, contributions based on those wages, and employer contributions on a revised quarterly employer tax report (form oq). Combined payroll tax reports form oq. Put the bin and quarter/year on each report. Combined payroll tax reports form oq. •keep copies of form oq, schedule b, form 132, and form or‑otc for your records. Download and save the form to your computer, then open it in adobe reader to complete and print. Log in, select withholding payroll, and click on i want to make an. Designed for employers, this form ensures compliance. • report whole hours on form oq (wbf assess‑ ment) and on form 132. File a quarterly tax report, oregon employment form oq. Download and save the form to your computer, then open it in adobe reader to complete and print. Oregon payroll reporting system (oprs) electronic filing. •keep copies of form oq, schedule b, form 132, and form or‑otc for your records. As long as you are registered as an employer, you must file form oq, even if you have no payroll during the reporting period. You must include an otc with form oq if you are sending a payment. How do i file quarterly taxes in. Beginning with the third quarter 2022, oregon employers will use the frances online website to upload and complete your quarterly filing. Log in, select withholding payroll, and click on i want to make an otc payment. you must include one form with each payment. Use only to report quarters with no payroll or no hours worked. Combined payroll tax reports. Log in, select withholding payroll, and click on i want to make an otc payment. you must include one form with each payment. Blank forms are available online or by order. We don't recommend using your web browser to complete the form, as. Employers who must file statewide transit tax on a quarterly basis will now file with the new. Use only to report quarters with no payroll or no hours worked. As long as you are registered as an employer, you must file form oq, even if you have no payroll during the reporting period. You must include an otc with form oq if you are sending a payment. • report whole hours on form oq (wbf assess‑ ment). Choose a quarterly report filing method: Put the bin and quarter/year on each report. File a quarterly tax report, oregon employment form oq. Employers who must file statewide transit tax on a quarterly basis will now file with the new form oq (quarterly employer tax report) and form 132 (oregon employee detail report),. Oregon department of revenue created date: Designed for employers, this form ensures compliance. Combined payroll tax reports form oq. We don't recommend using your web browser to complete the form, as. • report whole hours on form oq (wbf assess‑ ment) and on form 132. •keep copies of form oq, schedule b, form 132, and form or‑otc for your records. Oregon department of revenue created date: File a quarterly tax report, oregon employment form oq. Use the correct oregon business identification • report whole hours on form oq (wbf assessment) number (bin). Combined payroll tax reports form oq. Download and save the form to your computer, then open it in adobe reader to complete and print. Blank forms are available online or by order. Beginning with the third quarter 2022, oregon employers will use the frances online website to upload and complete your quarterly filing. •keep copies of form oq, schedule b, form 132, and form or‑otc for your records. How do i file quarterly taxes in oregon? File a quarterly tax report, oregon employment form. Put the bin and quarter/year on each report. • report whole hours on form oq (wbf assess‑ ment) and on form 132. How do i file quarterly taxes in oregon? Employers will report subject employee wages, contributions based on those wages, and employer contributions on a revised quarterly employer tax report (form oq). Form oq, the quarterly tax report, must be filed each quarter to document how you calculate the amount of withholding tax, ui tax, trimet and lane transit district taxes, and wbf. Combined payroll tax reports form oq. Oregon payroll reporting system (oprs) electronic filing. Download and save the form to your computer, then open it in adobe reader to complete and print. Combined payroll tax reports form oq. Log in, select withholding payroll, and click on i want to make an otc payment. you must include one form with each payment. Oregon department of revenue created date: Designed for employers, this form ensures compliance. File a quarterly tax report, oregon employment form oq. We don't recommend using your web browser to complete the form, as. As long as you are registered as an employer, you must file form oq, even if you have no payroll during the reporting period. Beginning with the third quarter 2022, oregon employers will use the frances online website to upload and complete your quarterly filing.Form Oq Oregon Quarterly Tax Report 2000 printable pdf download

Form OqWbf Quarterly Tax Report 2005 printable pdf download

Form OqWbf Quarterly Tax Report Oregon Dept. Of Revenue 2004

Form Oq Oregon Quarterly Tax Report printable pdf download

Fillable Online ifve Oregon Form Oq. oregon form oq ifve Fax Email

eSign Oq Complete with ease airSlate SignNow

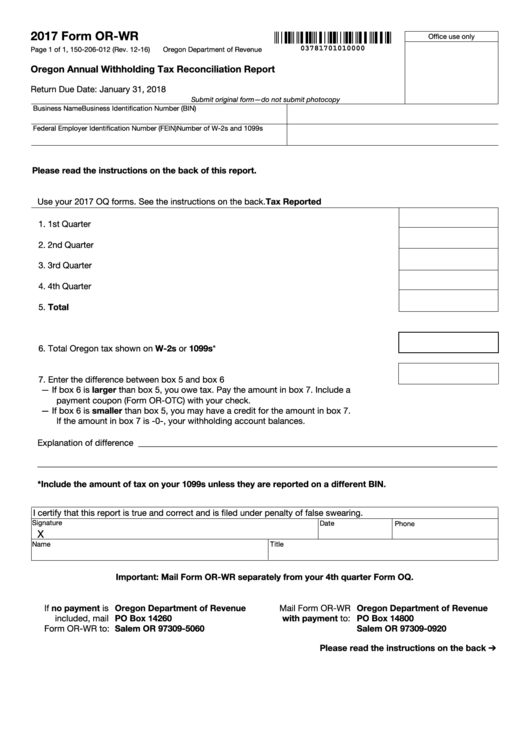

Fillable Form OrWr, Oregon Annual Withholding Tax printable pdf download

Form OQ (150206521) Fill Out, Sign Online and Download Fillable PDF

20182024 Form OR ORWR Fill Online, Printable, Fillable, Blank pdfFiller

Oregon Form Oq Fill Online, Printable, Fillable, Blank pdfFiller

Blank Forms Are Available Online Or By Order.

Choose A Quarterly Report Filing Method:

•Keep Copies Of Form Oq, Schedule B, Form 132, And Form Or‑Otc For Your Records.

Use Only To Report Quarters With No Payroll Or No Hours Worked.

Related Post: