Pa Sales Tax Exempt Form

Pa Sales Tax Exempt Form - Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and educational organizations and volunteer fire or. Experienced & trusted free consultation & quote no hidden fees Download and print this form to claim exemption from state and local sales and use tax, pta rental fee, hotel occupancy tax, and vehicle rental tax in pennsylvania. Issue a pennsylvania resale certificate to vendors for purchase of items for resale. Learn how to apply for sales and use tax exemption as an institution in pennsylvania. If purchaser does not have a pa sales tax license number, complete number 7 explaining why such number is not required. This form may be used in. Experienced & trusted free consultation & quote no hidden fees While the pennsylvania sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. What purchases are exempt from the pennsylvania sales tax? This form is used to claim exemption from state and local sales and use tax, hotel occupancy tax, pta tax, vrt and other taxes and fees for certain purchases or services. Learn how to apply for sales and use tax exemption as an institution in pennsylvania. While the pennsylvania sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. Experienced & trusted free consultation & quote no hidden fees Download and print this form to claim exemption from state and local sales and use tax, pta rental fee, hotel occupancy tax, and vehicle rental tax in pennsylvania. This form may be used in. What purchases are exempt from the pennsylvania sales tax? If purchaser does not have a pa sales tax license number, complete number 7 explaining why such number is not required. Find out the required documents, instructions and contact information for registration, renewal or update. Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and educational organizations and volunteer fire or. While the pennsylvania sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. What purchases are exempt from the pennsylvania sales tax? Issue a pennsylvania resale certificate to vendors for purchase of items for resale. Learn how to apply for sales and use tax exemption as an institution in pennsylvania. Vendors may. What purchases are exempt from the pennsylvania sales tax? If purchaser does not have a pa sales tax license number, complete number 7 explaining why such number is not required. Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and educational organizations and volunteer fire or. Issue a pennsylvania resale certificate. Experienced & trusted free consultation & quote no hidden fees Find out the required documents, instructions and contact information for registration, renewal or update. While the pennsylvania sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. Download and print this form to claim exemption from state and local sales and use. This form is used to claim exemption from state and local sales and use tax, hotel occupancy tax, pta tax, vrt and other taxes and fees for certain purchases or services. If purchaser does not have a pa sales tax license number, complete number 7 explaining why such number is not required. This form may be used in. Vendors may. This form is used to claim exemption from state and local sales and use tax, hotel occupancy tax, pta tax, vrt and other taxes and fees for certain purchases or services. Experienced & trusted free consultation & quote no hidden fees Experienced & trusted free consultation & quote no hidden fees This form may be used in. What purchases are. This form may be used in. This form is used to claim exemption from state and local sales and use tax, hotel occupancy tax, pta tax, vrt and other taxes and fees for certain purchases or services. Experienced & trusted free consultation & quote no hidden fees Issue a pennsylvania resale certificate to vendors for purchase of items for resale.. Issue a pennsylvania resale certificate to vendors for purchase of items for resale. This form is used to claim exemption from state and local sales and use tax, hotel occupancy tax, pta tax, vrt and other taxes and fees for certain purchases or services. Download and print this form to claim exemption from state and local sales and use tax,. Download and print this form to claim exemption from state and local sales and use tax, pta rental fee, hotel occupancy tax, and vehicle rental tax in pennsylvania. Issue a pennsylvania resale certificate to vendors for purchase of items for resale. While the pennsylvania sales tax of 6% applies to most transactions, there are certain items that may be exempt. Experienced & trusted free consultation & quote no hidden fees This exemption is valid for property or services to be resold: Issue a pennsylvania resale certificate to vendors for purchase of items for resale. Find out the required documents, instructions and contact information for registration, renewal or update. What purchases are exempt from the pennsylvania sales tax? This form may be used in. While the pennsylvania sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. If purchaser does not have a pa sales tax license number, complete number 7 explaining why such number is not required. Learn how to apply for sales and use tax exemption as an. Experienced & trusted free consultation & quote no hidden fees Download and print this form to claim exemption from state and local sales and use tax, pta rental fee, hotel occupancy tax, and vehicle rental tax in pennsylvania. This exemption is valid for property or services to be resold: This form may be used in. Find out the required documents, instructions and contact information for registration, renewal or update. Experienced & trusted free consultation & quote no hidden fees This form is used to claim exemption from state and local sales and use tax, hotel occupancy tax, pta tax, vrt and other taxes and fees for certain purchases or services. Learn how to apply for sales and use tax exemption as an institution in pennsylvania. If purchaser does not have a pa sales tax license number, complete number 7 explaining why such number is not required. While the pennsylvania sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.2023 Pa Tax Exempt Form Printable Forms Free Online

Form REV72 Fill Out, Sign Online and Download Fillable PDF

Fillable Tax Exempt Form Pa Printable Forms Free Online

Pa Tax Exempt Form Printable Printable Form 2024

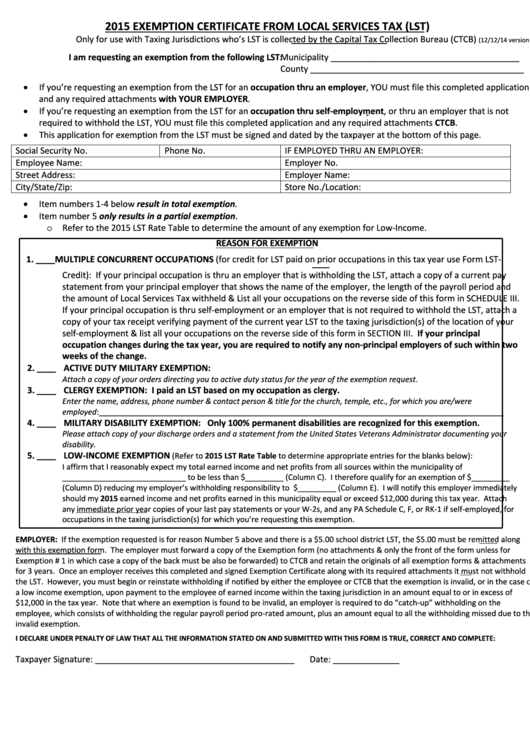

Exemption Certificate From Local Services Tax (Lst) Pennsylvania

Pa Tax Exempt Form Printable Printable Forms Free Online

Fillable Online Pa Resale Tax Exemption Certificate 02/2021 Fax Email

Pa Sales Tax Exemption 20172025 Form Fill Out and Sign Printable PDF

Pa exemption certificate Fill out & sign online DocHub

Pa Sales Tax Exemption Form 2024 Pdf Manya Ruperta

What Purchases Are Exempt From The Pennsylvania Sales Tax?

Vendors May Use This Declaration To Document Purchases Of Tax Free Items By Tax Exempt Organizations (Charitable, Religious And Educational Organizations And Volunteer Fire Or.

Issue A Pennsylvania Resale Certificate To Vendors For Purchase Of Items For Resale.

Related Post: