St50 Form

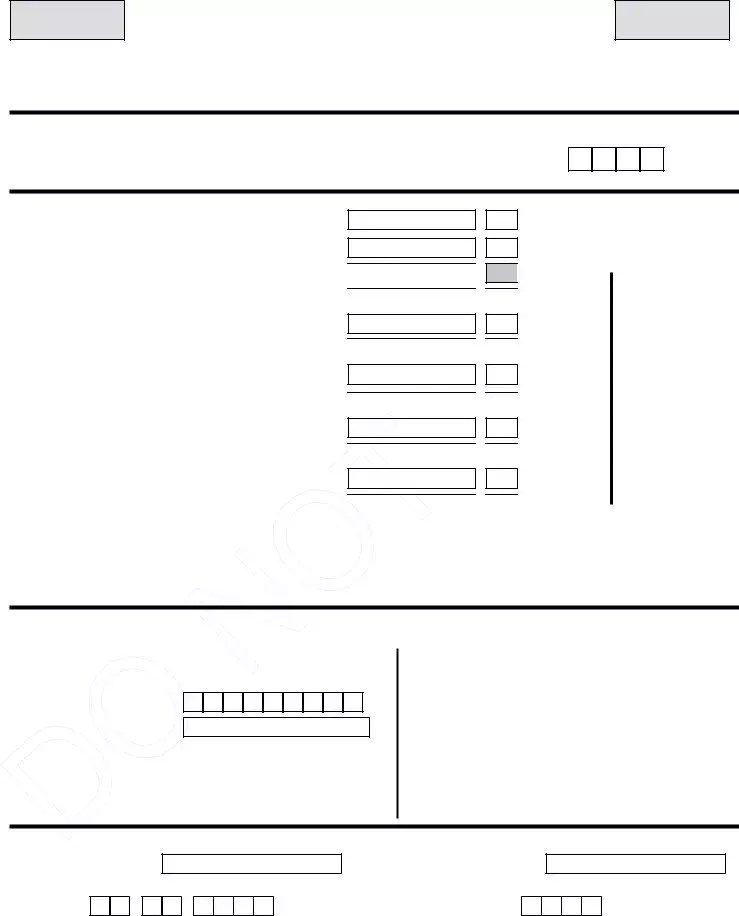

St50 Form - Taxpayers are not required to file monthly remittance statements. Of the 20th day of the month after the end of the filing period. Nj sales and use tax return This bulletin explains how and when to file the new jersey sales and use tax returns used by most businesses (forms st‐51 and st‐50), and the annual business use tax return (form. This specialized form allows individuals and. Quarterly sales and use tax returns are due before 11:59 p.m. Log in below using the first prompt. Enter your taxpayer identification number* and personal identification number (pin). Type of form format : St50 online help provides guidance on filing sales and use tax quarterly returns, including instructions for completing and submitting forms. To use the service, you will need a pin (personal identification number) number that is supplied by the division of taxation or simply enter your business name. Enter your taxpayer identification number* and personal identification number (pin). Businesses must complete this form to report gross receipts from sales, calculate sales tax. If you do not have a pin,. This bulletin explains how and when to file the new jersey sales and use tax returns used by most businesses (forms st‐51 and st‐50), and the annual business use tax return (form. Log in below using the first prompt. Taxpayers are not required to file monthly remittance statements. Of the 20th day of the month after the end of the filing period. If the due date falls on a weekend or legal holiday,. Nj sales and use tax return If the due date falls on a weekend or legal holiday,. Urban enterprise zone refunds of sales and use tax: Taxpayers are not required to file monthly remittance statements. St50 online help provides guidance on filing sales and use tax quarterly returns, including instructions for completing and submitting forms. Log in below using the first prompt. Nj sales and use tax return Log in below using the first prompt. To use the service, you will need a pin (personal identification number) number that is supplied by the division of taxation or simply enter your business name. Type of form format : Quarterly sales and use tax returns are due before 11:59 p.m. Quarterly sales and use tax returns are due before 11:59 p.m. Urban enterprise zone refunds of sales and use tax: If you do not have a pin,. File, pay, and access past filings and payments: If the due date falls on a weekend or legal holiday,. Nj sales and use tax return St50 online help provides guidance on filing sales and use tax quarterly returns, including instructions for completing and submitting forms. Urban enterprise zone refunds of sales and use tax: Of the 20th day of the month after the end of the filing period. If you do not have a pin,. St50 online help provides guidance on filing sales and use tax quarterly returns, including instructions for completing and submitting forms. Nj sales and use tax return Quarterly sales and use tax returns are due before 11:59 p.m. Taxpayers are not required to file monthly remittance statements. File, pay, and access past filings and payments: To use the service, you will need a pin (personal identification number) number that is supplied by the division of taxation or simply enter your business name. Of the 20th day of the month after the end of the filing period. Enter your taxpayer identification number* and personal identification number (pin). If you do not have a pin,. Taxpayers are. Urban enterprise zone refunds of sales and use tax: If you do not have a pin,. Log in below using the first prompt. Log in below using the first prompt. Businesses must complete this form to report gross receipts from sales, calculate sales tax. File, pay, and access past filings and payments: If the due date falls on a weekend or legal holiday,. Enter your taxpayer identification number* and personal identification number (pin). Nj sales and use tax return Of the 20th day of the month after the end of the filing period. Log in below using the first prompt. St50 online help provides guidance on filing sales and use tax quarterly returns, including instructions for completing and submitting forms. Quarterly sales and use tax returns are due before 11:59 p.m. If you do not have a pin,. Enter your taxpayer identification number* and personal identification number (pin). File, pay, and access past filings and payments: Businesses must complete this form to report gross receipts from sales, calculate sales tax. Enter your taxpayer identification number* and personal identification number (pin). Type of form format : St50 online help provides guidance on filing sales and use tax quarterly returns, including instructions for completing and submitting forms. To use the service, you will need a pin (personal identification number) number that is supplied by the division of taxation or simply enter your business name. Log in below using the first prompt. This bulletin explains how and when to file the new jersey sales and use tax returns used by most businesses (forms st‐51 and st‐50), and the annual business use tax return (form. St50 online help provides guidance on filing sales and use tax quarterly returns, including instructions for completing and submitting forms. Nj sales and use tax return Log in below using the first prompt. Enter your taxpayer identification number* and personal identification number (pin). File, pay, and access past filings and payments: If you do not have a pin,. File, pay, and access past filings and payments: This specialized form allows individuals and. Taxpayers are not required to file monthly remittance statements. Businesses must complete this form to report gross receipts from sales, calculate sales tax. If the due date falls on a weekend or legal holiday,. Enter your taxpayer identification number* and personal identification number (pin).Form St 50 Worksheets Library

Form ST50EN Download Printable PDF or Fill Online Sales and Use Tax

Fast & Effective Table formwork system for slab construction

Sf 52 Form Complete with ease airSlate SignNow

Fillable Form St50 Temporary Sales Tax Certificate/return printable

Form St 3 New Jersey ≡ Fill Out Printable PDF Forms Online

Fillable Form St Sales, Use, And Gross Receipts Tax North Dakota

Blank Nj Sales Tax Online St 50 Fill Out and Print PDFs

NJ Tax Form St 5 Fill Out and Sign Printable PDF Template airSlate

Nj St 5 Form ≡ Fill Out Printable PDF Forms Online

Of The 20Th Day Of The Month After The End Of The Filing Period.

Quarterly Sales And Use Tax Returns Are Due Before 11:59 P.m.

Type Of Form Format :

Urban Enterprise Zone Refunds Of Sales And Use Tax:

Related Post: