Tax Exemption Form Texas

Tax Exemption Form Texas - Learn how to apply for sales, franchise or hotel tax exemptions based on your organization's federal or state status. Since 2018, the requests to the texas state health agency for an exemption form have doubled from 45,900 to more than 93,000 in 2024. Find pdf forms for various sales and use tax applications, returns, exemptions, and certificates. This certificate should be furnished to the supplier. Legislators also have $3.5 billion set aside to pay for new cuts — expected in the form of another bump in the homestead exemption, more compression and tax cuts for. Sales and use tax “exemption numbers” or “tax exempt” numbers do not exist. Sales and use tax exemption numbers or tax exempt numbers do not exist. Find preprinted forms for various texas taxes, including sales and use tax, franchise tax, motor vehicle tax, and more. For applications for tax exemption, see the agricultural and timber. This certificate should be furnished to the supplier. Land is taxed based on what it earns in farming—not its market value. Learn the requirements, conditions and penalties for using this certificate. For example, you purchase a rescue ladder for. Sales and use tax exemption numbers or tax exempt numbers do not exist. Sales and use tax exemption numbers or tax exempt numbers do not exist. For applications for tax exemption, see the agricultural and timber. Find pdf forms for various sales and use tax applications, returns, exemptions, and certificates. Do not send the completed certificate to the comptroller of. This certificate should be furnished to the supplier. Do not send the completed certificate to the comptroller of. Sales and use tax exemption numbers or tax exempt numbers do not exist. Download and print the official form for claiming tax exemption or resale of taxable items in texas. Do not send the completed certificate to the comptroller of. Download and print the form you need or file electronically online. Sales and use tax exemption numbers or tax exempt. Sales and use tax exemption numbers or tax exempt numbers do not exist. This certificate should be furnished to the supplier. “it eliminates a portion of your school [maintenance and operations] tax bill.” homeowners aged 65 years or older would qualify for an additional $10,000, for a total. If an item exceeds the maximum amount with these charges, the tax. Download and print the form you need or file electronically online. Learn how to apply for sales, franchise or hotel tax exemptions based on your organization's federal or state status. I, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice. Sales and use tax exemption numbers or tax exempt numbers do not exist. Sales and use tax exemption numbers or tax exempt numbers do not exist. All requests for exemptions are granted. Find pdf forms for various types of tax exemptions in texas, such as federal, charitable, educational, religious, and performing charitable functions. A sales tax exemption certificate can be. Do not send the completed certificate to the comptroller of. I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice) from: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of. The form is page 2 of the. This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items). Sales and use tax “exemption numbers” or “tax exempt” numbers do not exist. Sales and use tax exemption numbers or tax exempt numbers do not exist. Find pdf forms for various types. Since 2018, the requests to the texas state health agency for an exemption form have doubled from 45,900 to more than 93,000 in 2024. Download and print the form you need or file electronically online. I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on. Find preprinted forms for various texas taxes, including sales and use tax, franchise tax, motor vehicle tax, and more. Sales and use tax exemption numbers or tax exempt numbers do not exist. Legislators also have $3.5 billion set aside to pay for new cuts — expected in the form of another bump in the homestead exemption, more compression and tax. The form is page 2 of the. Download and print the form you need or file electronically online. If an item exceeds the maximum amount with these charges, the tax exemption no longer applies. This certificate should be furnished to the supplier. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making. Find preprinted forms for various texas taxes, including sales and use tax, franchise tax, motor vehicle tax, and more. This certificate should be furnished to the supplier. Sales and use tax exemption numbers or tax exempt numbers do not exist. Find pdf forms for various types of tax exemptions in texas, such as federal, charitable, educational, religious, and performing charitable. If an item exceeds the maximum amount with these charges, the tax exemption no longer applies. Download a copy of the texas sales and use tax exemption certificate from the tax form section of the state of texas website (see resource). All requests for exemptions are granted. Do not send the completed certificate to the comptroller of. I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice) from: Sales and use tax exemption numbers or tax exempt numbers do not exist. Sales and use tax exemption numbers or tax exempt numbers do not exist. This certificate should be furnished to the supplier. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the texas sales tax. Since 2018, the requests to the texas state health agency for an exemption form have doubled from 45,900 to more than 93,000 in 2024. Do not send the completed certificate to the comptroller of. I, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice form: Find pdf forms for various sales and use tax applications, returns, exemptions, and certificates. Land is taxed based on what it earns in farming—not its market value. You can download a pdf of. Sales and use tax exemption numbers or tax exempt numbers do not exist.Fillable Form 50 759 Application For Property Tax Exemption Texas

Fillable Form 69315 Texas Certificate Of Tax Exempt Sale printable

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF

Tax exempt form texas Fill out & sign online DocHub

Texas Tax Exemption Certificate Fill Online, Printable, Fillable

Fillable Form 01 339 Back Texas Sales And Use Tax Exemption

Tax Exempt Form Texas Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Form 01 339 Back Texas Sales And Use Tax Exemption

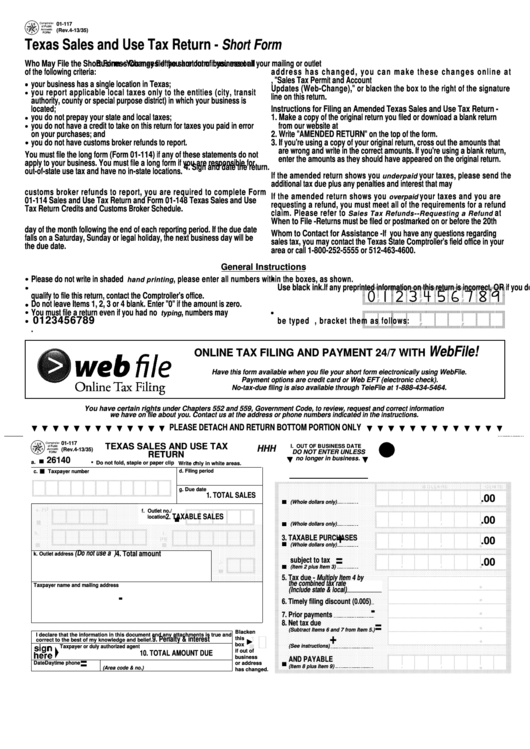

Fillable Texas Sales And Use Tax Form printable pdf download

Fillable Texas Tax Exempt Form Printable Forms Free Online

This Form Is Used To Claim An Exemption From Payment Of Sales And Use Taxes (For The Purchase Of Taxable Items).

For Example, You Purchase A Rescue Ladder For.

Find Pdf Forms For Various Types Of Tax Exemptions In Texas, Such As Federal, Charitable, Educational, Religious, And Performing Charitable Functions.

Sales And Use Tax Exemption Numbers Or Tax Exempt Numbers Do Not Exist.

Related Post: