Tax Form 8949 Instructions

Tax Form 8949 Instructions - 31, 2024, for section 6426/6427 credits and refunds. The form captures detailed information about each transaction,. Form 8949 is an irs tax document used to report gains and losses from the sale or exchange of capital assets. Purpose of form use form 8949 to report sales and exchanges of capital assets. Find the current and previous versions of. The irs instructions for form 8949 state that it is used to report sales and exchanges of capital assets. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949. Purpose of form use form 8949 to report sales and exchanges of capital assets. While you’ve probably sold plenty of capital assets, you may have never heard of form 8949. Continue to use the schedule 3 (form 8849), january 2023 revision for any claims before dec. Whether you’ve sold stocks, bonds, or cryptocurrency, understanding how to file form 8949 correctly can help you avoid errors and potential tax penalties. Form 8949 sales and other dispositions of capital assets 2025 department of the treasury internal revenue service file with your schedule d to list your transactions for lines 1b, 2, 3,. Form 8949, sales and other dispositions of capital assets is a critical document used to report the sale or exchange of capital assets, including stocks, bonds, and. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. This is an irs form used by individuals, partnerships, and. Form 8949 is an irs tax document used to report gains and losses from the sale or exchange of capital assets. Learn how to accurately complete irs form 8949 to report capital gains and losses, including key. The irs instructions for form 8949 state that it is used to report sales and exchanges of capital assets. In this guide, we’ll walk you. When selling a capital asset, the irs requires you to fill out form 8949. Use form 8949 to report sales and other dispositions of capital assets on your tax return. Whether you’ve sold stocks, bonds, or cryptocurrency, understanding how to file form 8949 correctly can help you avoid errors and potential tax penalties. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949.. This is an irs form used by individuals, partnerships, and. Use form 8949 to report sales and other dispositions of capital assets on your tax return. Learn how to accurately complete irs form 8949 to report capital gains and losses, including key. Form 8949 sales and other dispositions of capital assets 2025 department of the treasury internal revenue service file. Form 8949, sales and other dispositions of capital assets is a critical document used to report the sale or exchange of capital assets, including stocks, bonds, and. Purpose of form use form 8949 to report sales and exchanges of capital assets. This is an irs form used by individuals, partnerships, and. Whether you’ve sold stocks, bonds, or cryptocurrency, understanding how. This is an irs form used by individuals, partnerships, and. Whether you’ve sold stocks, bonds, or cryptocurrency, understanding how to file form 8949 correctly can help you avoid errors and potential tax penalties. The form captures detailed information about each transaction,. Purpose of form use form 8949 to report sales and exchanges of capital assets. Continue to use the schedule. In this guide, we’ll walk you. Learn how to accurately complete irs form 8949 to report capital gains and losses, including key. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Instructions for irs form 8949: If you must report capital gains and losses from an investment in the past year, you’ll. Whether you’ve sold stocks, bonds, or cryptocurrency, understanding how to file form 8949 correctly can help you avoid errors and potential tax penalties. 31, 2024, for section 6426/6427 credits and refunds. This is an irs form used by individuals, partnerships, and. Form 8949 is an irs tax form used to report capital gains and losses from the sale of stocks,. Purpose of form use form 8949 to report sales and exchanges of capital assets. Instructions for irs form 8949: Form 8949 sales and other dispositions of capital assets 2025 department of the treasury internal revenue service file with your schedule d to list your transactions for lines 1b, 2, 3,. Learn how to accurately complete irs form 8949 to report. This is an irs form used by individuals, partnerships, and. 31, 2024, for section 6426/6427 credits and refunds. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949. Use form 8949 to report sales and exchanges of capital assets. The irs instructions for form 8949 state that it is. This is an irs form used by individuals, partnerships, and. Find the current and previous versions of. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949. When selling a capital asset,. Form 8949 sales and other dispositions of capital assets 2025 department of the treasury internal revenue service file with your schedule d to list your transactions for lines 1b, 2, 3,. The form captures detailed information about each transaction,. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Form 8949, sales and. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. The form captures detailed information about each transaction,. Continue to use the schedule 3 (form 8849), january 2023 revision for any claims before dec. Whether you’ve sold stocks, bonds, or cryptocurrency, understanding how to file form 8949 correctly can help you avoid errors and potential tax penalties. Find the current and previous versions of. Form 8949, sales and other dispositions of capital assets is a critical document used to report the sale or exchange of capital assets, including stocks, bonds, and. Purpose of form use form 8949 to report sales and exchanges of capital assets. This is an irs form used by individuals, partnerships, and. In this guide, we’ll walk you. Use form 8949 to report sales and exchanges of capital assets. Form 8949 sales and other dispositions of capital assets 2025 department of the treasury internal revenue service file with your schedule d to list your transactions for lines 1b, 2, 3,. While you’ve probably sold plenty of capital assets, you may have never heard of form 8949. Purpose of form use form 8949 to report sales and exchanges of capital assets. Instructions for irs form 8949: Form 8949 is used by both individual taxpayers as well as corporations and. Use form 8949 to report sales and exchanges of capital assets.IRS Form 8949 Instructions

IRS Form 8949 Instructions

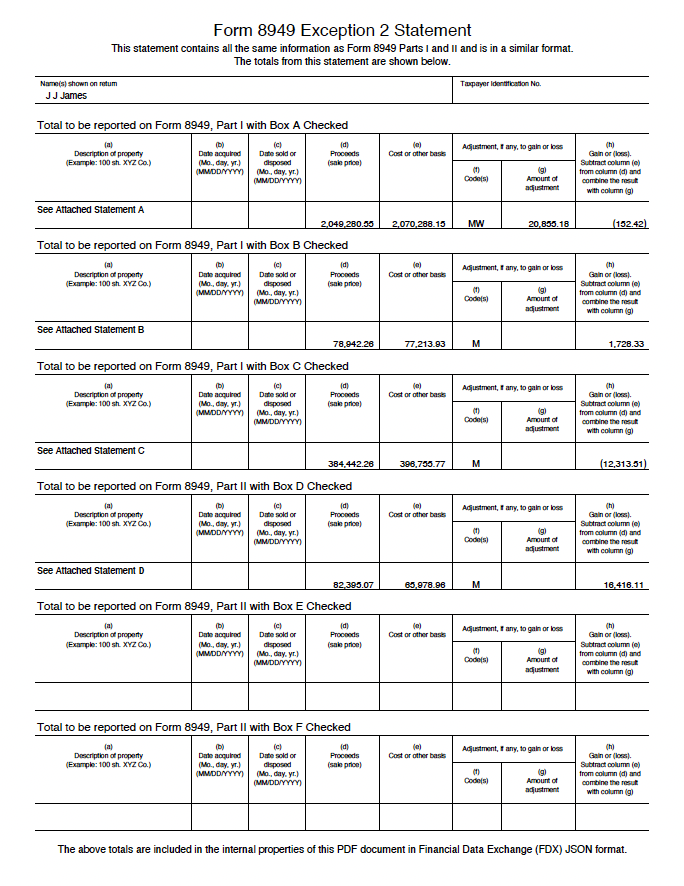

Explanation of IRS Form 8949 Exception 2

IRS Form 8949 Instructions

Download Instructions for IRS Form 8949 Sales and Other Dispositions of

Understanding IRS Form 8949 Instructions

Form 8949 Instructions 2023 Printable Forms Free Online

IRS Form 8949 Instructions

IRS Form 8949 Instructions

IRS Form 8949 Instructions

The Irs Instructions For Form 8949 State That It Is Used To Report Sales And Exchanges Of Capital Assets.

Use Form 8949 To Report Sales And Other Dispositions Of Capital Assets On Your Tax Return.

Learn How To Accurately Complete Irs Form 8949 To Report Capital Gains And Losses, Including Key.

Complete Form 8949 Before You Complete Line 1B, 2, 3, 8B, 9, Or 10 Of Schedule D.

Related Post: