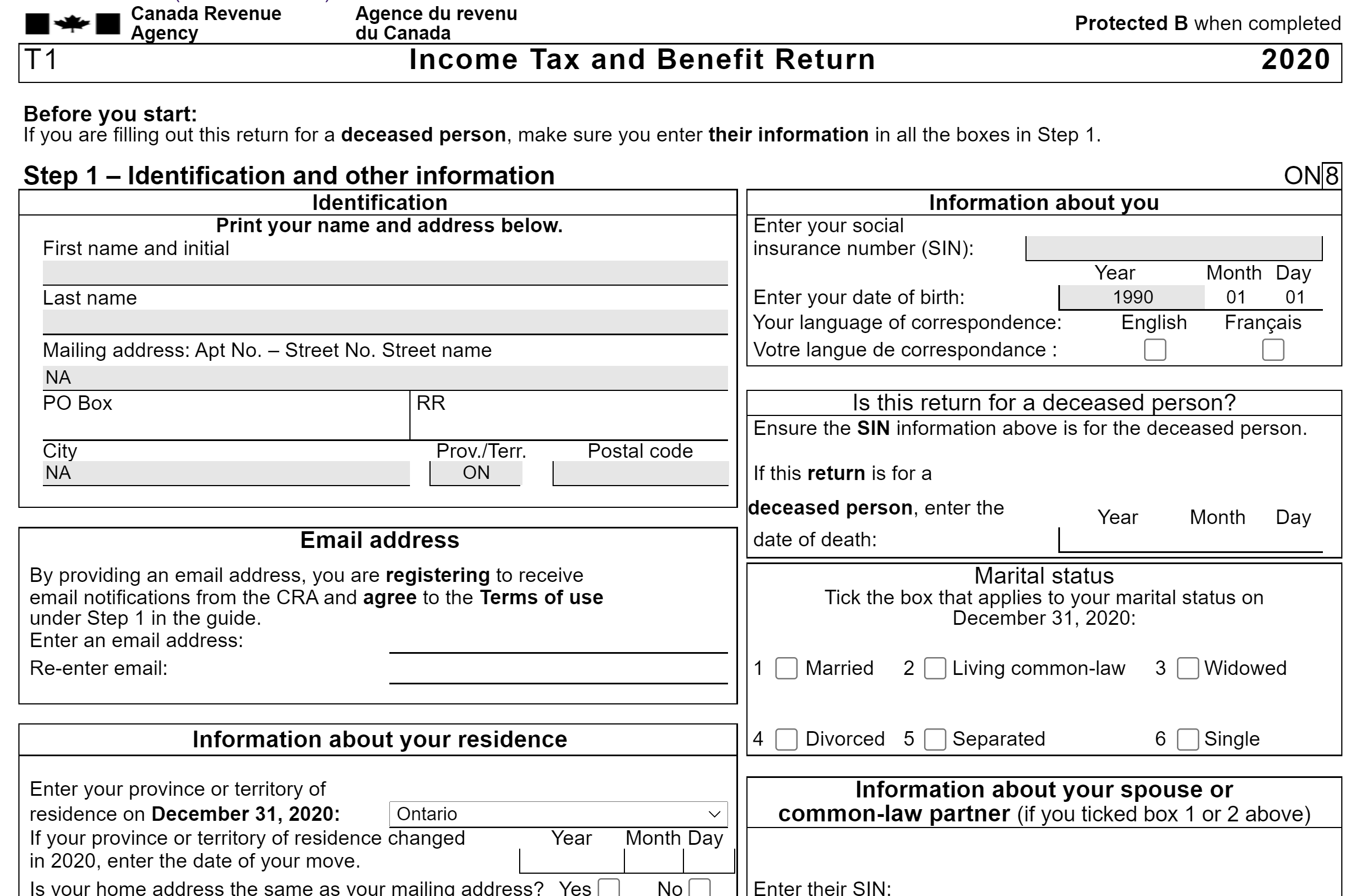

Tax T1 Form

Tax T1 Form - The t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return. Plus, explore the benefits of mortgage investment corporations (mics) for. All canadians are required to fill and submit this form, which also declares all income you have. Individuals and business owners such as. The t1 form is a summary of all income taxes you pay to the cra. Filing your t1 return accurately is vital. The t1 general form is a personal tax form filed with the canada revenue agency (cra) as an annual income tax return. A t1 tax return, also known as the general income tax and benefit return, is the primary form that canadian individuals use to file their annual income tax return. What is a t1 form? It captures everything from total income to net income to taxable income and lets you. Individuals and business owners such as. To obtain the current year’s t1 general form, visit the t1 income tax package page on the cra site. It captures everything from total income to net income to taxable income and lets you. What is a t1 general income tax form? Use tax software or consult a tax professional to ensure you maximize benefits and avoid common pitfalls. The t1 general form is the primary document used to file personal income taxes in canada. On tuesday, ryan minor, director of tax with cpa canada in sudbury, ont., posted on linkedin confirmation from the cra that the filing extension applies to t1 filers who. Plus, explore the benefits of mortgage investment corporations (mics) for. Filing your t1 return accurately is vital. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better known as. The t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return. What is a t1 form? To obtain the current year’s t1 general form, visit the t1 income tax package page on the cra site. On tuesday, ryan minor, director of tax with cpa canada. Choose your province or territory to download the appropriate form. Use tax software or consult a tax professional to ensure you maximize benefits and avoid common pitfalls. All canadians are required to fill and submit this form, which also declares all income you have. The primary document you need to file personal income taxes in canada is the income tax. A t1 tax return, also known as the general income tax and benefit return, is the primary form that canadian individuals use to file their annual income tax return. On tuesday, ryan minor, director of tax with cpa canada in sudbury, ont., posted on linkedin confirmation from the cra that the filing extension applies to t1 filers who. In this. To obtain the current year’s t1 general form, visit the t1 income tax package page on the cra site. All canadians are required to fill and submit this form, which also declares all income you have. What is a t1 tax return? Individuals and business owners such as. The primary document you need to file personal income taxes in canada. What is a t1 form? To obtain the current year’s t1 general form, visit the t1 income tax package page on the cra site. The t1 form is a summary of all income taxes you pay to the cra. The t1 general form is a personal tax form filed with the canada revenue agency (cra) as an annual income tax. To obtain the current year’s t1 general form, visit the t1 income tax package page on the cra site. Use tax software or consult a tax professional to ensure you maximize benefits and avoid common pitfalls. In this guide, we’ll discuss the t1 form, including who should fill it out, when and how to file it, and its various sections.. Plus, explore the benefits of mortgage investment corporations (mics) for. In this guide, we’ll discuss the t1 form, including who should fill it out, when and how to file it, and its various sections. A t1 tax return, also known as the general income tax and benefit return, is the primary form that canadian individuals use to file their annual. All canadians are required to fill and submit this form, which also declares all income you have. Individuals and business owners such as. What is a t1 general income tax form? The t1 form is a summary of all income taxes you pay to the cra. Choose your province or territory to download the appropriate form. What is a t1 general income tax form? What is a t1 form? The t1 general form is the primary document used to file personal income taxes in canada. The t1 general form is a personal tax form filed with the canada revenue agency (cra) as an annual income tax return. Individuals and business owners such as. In this guide, we’ll discuss the t1 form, including who should fill it out, when and how to file it, and its various sections. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better known as. On tuesday, ryan minor, director of tax with cpa canada in sudbury, ont.,. The t1 general form is the primary document used to file personal income taxes in canada. In this guide, we’ll discuss the t1 form, including who should fill it out, when and how to file it, and its various sections. Use tax software or consult a tax professional to ensure you maximize benefits and avoid common pitfalls. What is a t1 general income tax form? A t1 tax return, also known as the general income tax and benefit return, is the primary form that canadian individuals use to file their annual income tax return. Understanding the t1 general form is crucial for every canadian taxpayer. All canadians are required to fill and submit this form, which also declares all income you have. The t1 form is a summary of all income taxes you pay to the cra. On tuesday, ryan minor, director of tax with cpa canada in sudbury, ont., posted on linkedin confirmation from the cra that the filing extension applies to t1 filers who. To obtain the current year’s t1 general form, visit the t1 income tax package page on the cra site. It captures everything from total income to net income to taxable income and lets you. It’s the key to effectively managing your taxable income, net income, and total income. Plus, explore the benefits of mortgage investment corporations (mics) for. The t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return. Choose your province or territory to download the appropriate form. Individuals and business owners such as.Form T1OVPS Download Fillable PDF or Fill Online Simplified Individual Tax Return for Rrsp

What is a T1 General Tax Form? Canada Buzz

Preparing T1 Returns Reporting and inputting Tslips on the T1 tax return (Part 2 of 5

Canadian 2012 T1 Tax Form HighRes Stock Photo Getty Images

Form T1OVP 2022 Fill Out, Sign Online and Download Fillable PDF, Canada Templateroller

Form T1 General Tax And Benefit Return 2015 printable pdf download

Canada Tax Return

Canada Form T1 Ovp E ≡ Fill Out Printable PDF Forms Online

Form T1OVP 2019 Fill Out, Sign Online and Download Fillable PDF, Canada Templateroller

Canada T1 General 2015 Fill and Sign Printable Template Online US Legal Forms

Filing Your T1 Return Accurately Is Vital.

The Primary Document You Need To File Personal Income Taxes In Canada Is The Income Tax And Benefit Return Form, Better Known As.

What Is A T1 Tax Return?

What Is A T1 Form?

Related Post: