Texas Form C-3

Texas Form C-3 - To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. If report information is not available within three business days,. A mix of clouds and sun. The employer's quarterly report is a required document for texas employers. The state of texas requires all employers to report unemployment insurance wages and pay their quarterly taxes electronically. Texas requires electronic filing for these forms. In this section, you can find the different employer’s quarterly wage report filing options. Winds ssw at 10 to 20 mph. 37 texas workforce commission forms and templates are collected for any of your. If your address has changed, please update your account. How do we apply for an exemption? A mix of clouds and sun. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. In this section, you can find the different employer’s quarterly wage report filing options. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. Texas requires electronic filing for these forms. Winds ssw at 10 to 20 mph. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. If report information is not available within three business days,. 37 texas workforce commission forms and templates are collected for any of your. In this section, you can find the different employer’s quarterly wage report filing options. The texas workforce commission (twc) uses optical character recognition (ocr) equipment to efficiently input wage and tax records (forms c3 and c4) into the twc database, and. Its primary purpose is to ensure compliance with state. How do we apply for an exemption? If your address. The texas workforce commission (twc) uses optical character recognition (ocr) equipment to efficiently input wage and tax records (forms c3 and c4) into the twc database, and. The purpose of this communication is to inform school systems of the final college, career, or military readiness outcomes bonus (ccmr ob) report and student listing for the. To calculate the tax due,. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. Winds ssw at 10 to 20 mph. A mix of clouds and sun. These forms can only be. 37 texas workforce commission forms and templates are collected for any of your. Winds ssw at 10 to 20 mph. Texas requires electronic filing for these forms. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. Its primary purpose is to ensure compliance with state. If report information is not available within three business days,. These forms can only be. 37 texas workforce commission forms and templates are collected for any of your. The texas workforce commission (twc) uses optical character recognition (ocr) equipment to efficiently input wage and tax records (forms c3 and c4) into the twc database, and. A qualifying 501(c) must apply for state tax exemption. If report information is not available. Complete the form accurately to ensure. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter 2014. In this section, you can find the different employer’s quarterly wage report filing options. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. The. The purpose of this communication is to inform school systems of the final college, career, or military readiness outcomes bonus (ccmr ob) report and student listing for the. Winds ssw at 10 to 20 mph. The texas workforce commission (twc) uses optical character recognition (ocr) equipment to efficiently input wage and tax records (forms c3 and c4) into the twc. Winds ssw at 10 to 20 mph. If report information is not available within three business days,. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. The employer's quarterly report is a required document for texas employers. Texas requires electronic filing for these forms. A mix of clouds and sun. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. Texas employer new hire reporting form submit within 20 calendar days of new employee’s first day of work to: Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter. Winds ssw at 10 to 20 mph. Its primary purpose is to ensure compliance with state. If your address has changed, please update your account. The employer's quarterly report is a required document for texas employers. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter 2014. Winds ssw at 10 to 20 mph. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. The employer's quarterly report is a required document for texas employers. The state of texas requires all employers to report unemployment insurance wages and pay their quarterly taxes electronically. How do we apply for an exemption? Texas employer new hire reporting form submit within 20 calendar days of new employee’s first day of work to: These forms can only be. If report information is not available within three business days,. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. 37 texas workforce commission forms and templates are collected for any of your. Texas requires electronic filing for these forms. Its primary purpose is to ensure compliance with state. A mix of clouds and sun. The texas workforce commission (twc) uses optical character recognition (ocr) equipment to efficiently input wage and tax records (forms c3 and c4) into the twc database, and. In this section, you can find the different employer’s quarterly wage report filing options. The purpose of this communication is to inform school systems of the final college, career, or military readiness outcomes bonus (ccmr ob) report and student listing for the.Form C 3 Hm Customs And Excise printable pdf download

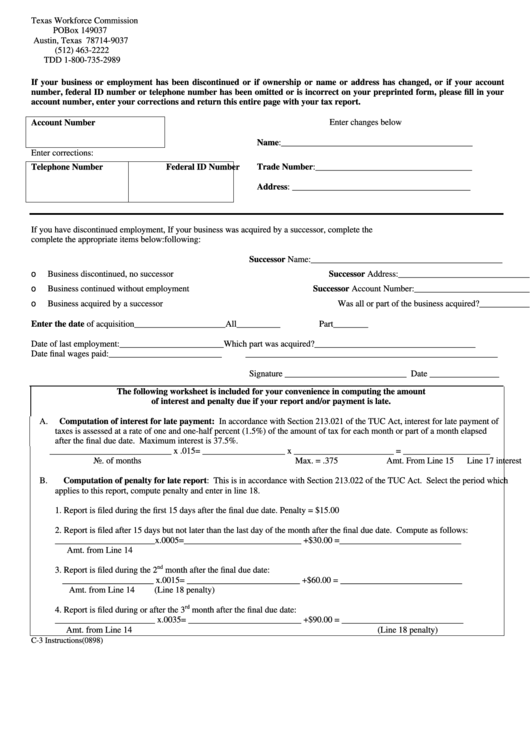

Form C3 Employer'S Quarterly Report Texas Workforce Commission

TX AP2281 2020 Fill out Tax Template Online US Legal Forms

Form C3 Employer'S Quarterly Report printable pdf download

Form C3 Employer'S Quarterly Report Instructions printable pdf download

Form C7 Fill Out, Sign Online and Download Fillable PDF, Texas

Nc D400 20192025 Form Fill Out and Sign Printable PDF Template

TX C1 20152022 Fill and Sign Printable Template Online US Legal Forms

Form C 3 2020 Fill and Sign Printable Template Online US Legal Forms

3 Uge 20112025 Form Fill Out and Sign Printable PDF Template

To Calculate The Tax Due, Enter The Tax Rate (Item 4), Taxable Wages (Item 14),.

If Your Address Has Changed, Please Update Your Account.

This File Contains Instructions For Reporting Employee Wages And Taxes.

A Qualifying 501(C) Must Apply For State Tax Exemption.

Related Post: