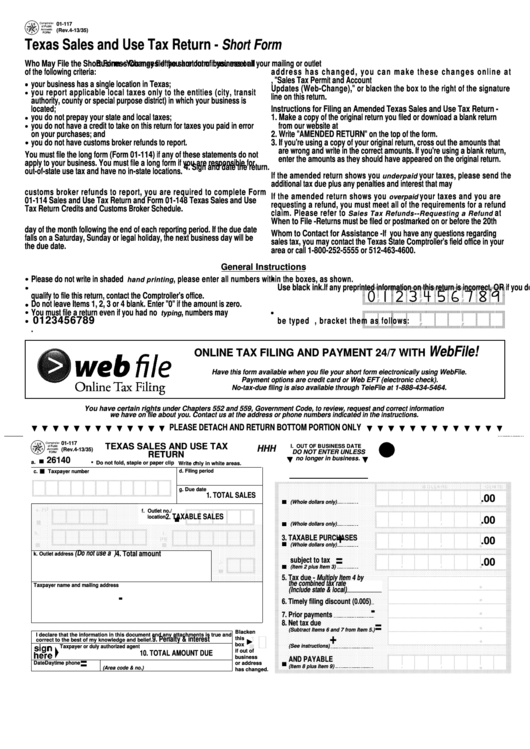

Texas Sales And Use Tax Return Short Form

Texas Sales And Use Tax Return Short Form - Returns must be filed for every period even if there is no amount subject to tax or any tax due. Make a copy of the original return you filed or download a blank return from our website at. Complete and detailed records must be kept of all sales as well as any deductions claimed so. Do not staple or paper clip. 111.060 and 111.061) sales, leases and rentals of tangible personal property including all. Enter the total amount (not including tax) of all sales, services, leases and rentals of tangible personal property including all related charges made in texas during the reporting period. View, download and print fillable texas sales and use tax in pdf format online. This worksheet is for taxpayers who report yearly, qualify to file the short form and have experienced a local sales tax rate change during the calendar year. Free consultation & quote experienced & trusted no hidden fees Sales and use tax applications. Texas sales and use tax return. Have this form available when you file your short form electronically using webfile. Browse 33 texas sales tax form templates collected for any of your needs. Make a copy of the original return you filed or download a blank return from our website at. Your business has a single location in texas;. Sales and use tax applications. You may use telefile even if total sales are greater than zero if no. Enter the total amount (not including tax) of all sales, services, leases and rentals of tangible personal property including all related charges made in texas during the reporting period. Tx sales and use tax return (short form) Apply for a sales tax permit online! Apply for a sales tax permit online! Payment options are credit card or web eft (electronic check). Do not write in shaded areas. Returns must be filed for every period even if there is no amount subject to tax or any tax due. Download and print the short form for filing texas sales and use tax returns if you meet. Do not staple or paper clip. Enter the total amount (not including tax) of all services and (texas tax code ann. Texas sales and use tax return. Payment options are credit card or web eft (electronic check). 111.060 and 111.061) sales, leases and rentals of tangible personal property including all. Texas sales and use tax return glenn hegar texas comptroller of public accounts these instructions are provided to assist in properly completing the texas sales. Do not write in shaded areas. This worksheet is for taxpayers who report yearly, qualify to file the short form and have experienced a local sales tax rate change during the calendar year. Expert solutions. Do not staple or paper clip. Texas sales and use tax return. Returns must be filed for every period even if there is no amount subject to tax or any tax due. Enter the total amount (not including tax) of all services and (texas tax code ann. Browse 33 texas sales tax form templates collected for any of your needs. Leased or rented for personal or business use on which sales or use tax was not paid. Texas sales and use tax return. You have certain rights under chapters 552 and 559,. Learn how to complete the form, when to file, and whom to contact for assistance. Your business has a single location in texas;. Do not write in shaded areas. Returns must be filed for every period even if there is no amount subject to tax or any tax due. Learn how to complete the form, when to file, and whom to contact for assistance. Have this form available when you file your short form electronically using webfile. Tx sales and use tax return. Have this form available when you file your short form electronically using webfile. Returns must be filed for every period even if there is no amount subject to tax or any tax due. You may use telefile even if total sales are greater than zero if no. Complete and detailed records must be kept of all sales as well as. Expert solutions view our brochure corporate tax software cloud: Free consultation & quote experienced & trusted no hidden fees Payment options are credit card or web eft (electronic check). Do not staple or paper clip. Learn how to complete the form, when to file, and whom to contact for assistance. Payment options are credit card or web eft (electronic check). Do not write in shaded areas. Sales and use tax applications. This worksheet is for taxpayers who report yearly, qualify to file the short form and have experienced a local sales tax rate change during the calendar year. Enter the total amount (not including tax) of all services and (texas. Expert solutions view our brochure corporate tax software cloud: Enter the total amount (not including tax) of all sales, services, leases and rentals of tangible personal property including all related charges made in texas during the reporting period. Leased or rented for personal or business use on which sales or use tax was not paid. Do not staple or paper. This worksheet is for taxpayers who report yearly, qualify to file the short form and have experienced a local sales tax rate change during the calendar year. Free consultation & quote experienced & trusted no hidden fees You may use telefile even if total sales are greater than zero if no. Leased or rented for personal or business use on which sales or use tax was not paid. 111.060 and 111.061) sales, leases and rentals of tangible personal property including all. Returns must be filed for every period even if there is no amount subject to tax or any tax due. Complete and detailed records must be kept of all sales as well as any deductions claimed so. Do not staple or paper clip. You have certain rights under chapters 552 and 559,. Sales and use tax applications. Make a copy of the original return you filed or download a blank return from our website at. Download and print the short form for filing texas sales and use tax returns if you meet certain criteria. Texas sales and use tax return glenn hegar texas comptroller of public accounts these instructions are provided to assist in properly completing the texas sales. Enter the total amount (not including tax) of all services and (texas tax code ann. Your business has a single location in texas;. Apply for a sales tax permit online!Fillable Form 01118 Texas Sales And Use Tax Prepayment Report

Top 33 Texas Sales Tax Form Templates free to download in PDF format

Short Form Texas Sales and Use Tax Return PDF Use Tax Tax Refund

Fillable Form 01116A Texas List Supplement Sales And Use Tax

Texas Fireworks Tax Forms01117 Texas Sales & Use Tax Return Short…

Use/sales Tax Form printable pdf download

Texas Fireworks Tax Forms01117 Texas Sales & Use Tax Return Short…

Form Boe401Ez Short Form Sales And Use Tax Return printable pdf

Fillable Online Instructions for Completing Texas Sales and Use Tax

Fillable Texas Sales And Use Tax Form printable pdf download

View, Download And Print Fillable Texas Sales And Use Tax In Pdf Format Online.

Enter The Total Amount (Not Including Tax) Of All Sales, Services, Leases And Rentals Of Tangible Personal Property Including All Related Charges Made In Texas During The Reporting Period.

Learn How To Complete The Form, When To File, And Whom To Contact For Assistance.

Expert Solutions View Our Brochure Corporate Tax Software Cloud:

Related Post: