Tx C 3 Form

Tx C 3 Form - Options include unemployment tax services (uts) system, quickfile, intuit easyacct. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. In this section, you can find the different employer’s quarterly wage report filing options. It will be easier than ever for parents to opt their children out of public school vaccine requirements under a bill given initial passage in the texas house late tuesday. In the case of a discrepancy between these numbers and the official drawing results, the official drawing results will prevail. View the webcast of the official. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. You will need to download and. 519 texas tax forms and templates are collected for any of your needs. A federal tax exemption only applies to the specific organization to which it is granted. These forms can only be used if the employer has tx set as the. Determinations are based on the employee’s work situation and not the. You will need to download and. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. Texas employer new hire reporting form submit within 20 calendar days of new employee’s first day of work to: Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made. View the webcast of the official. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. In this section, you can find the different employer’s quarterly wage report filing options. It will be easier than ever for parents to opt their children out of public school vaccine requirements under a bill given initial passage in the texas house late tuesday. Texas employer new hire reporting form submit within 20 calendar days of new employee’s first day of work to: A federal tax exemption only applies to the specific organization to which it is granted. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. In this section, you can find the different. You will need to download and. These forms can only be used if the employer has tx set as the. It will be easier than ever for parents to opt their children out of public school vaccine requirements under a bill given initial passage in the texas house late tuesday. To expedite the processing of your tax returns, please file. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made. It will be easier than ever for parents to opt their children out of public school vaccine requirements under a bill given initial passage in the texas house late. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. View the webcast of the official. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. If you need additional continuation. A federal tax exemption only applies to the specific organization to which it is granted. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. It will be easier than ever for parents to opt their children out of public school vaccine requirements under a bill given initial passage in the texas house late tuesday. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. View the webcast. 519 texas tax forms and templates are collected for any of your needs. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. You will need to download and. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter 2014.. These forms can only be used if the employer has tx set as the. View the webcast of the official. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. Texas employer new hire reporting form submit within 20 calendar days of new employee’s first day of work to: If you need additional continuation. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter 2014. In this section, you can find the different employer’s quarterly wage report filing options. If you need additional continuation. It will be easier than ever for parents to opt their children out of public school vaccine requirements under a. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter 2014. A federal tax exemption only applies to the. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. If your address has changed, please update your account. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made.. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. View the webcast of the official. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. If your address has changed, please update your account. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. Texas employer new hire reporting form submit within 20 calendar days of new employee’s first day of work to: 519 texas tax forms and templates are collected for any of your needs. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter 2014. In this section, you can find the different employer’s quarterly wage report filing options. In the case of a discrepancy between these numbers and the official drawing results, the official drawing results will prevail. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. These forms can only be used if the employer has tx set as the. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made. 501 (c) (3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. Its primary purpose is to ensure compliance with state.TX TEC C/OH 20152021 Fill and Sign Printable Template Online US

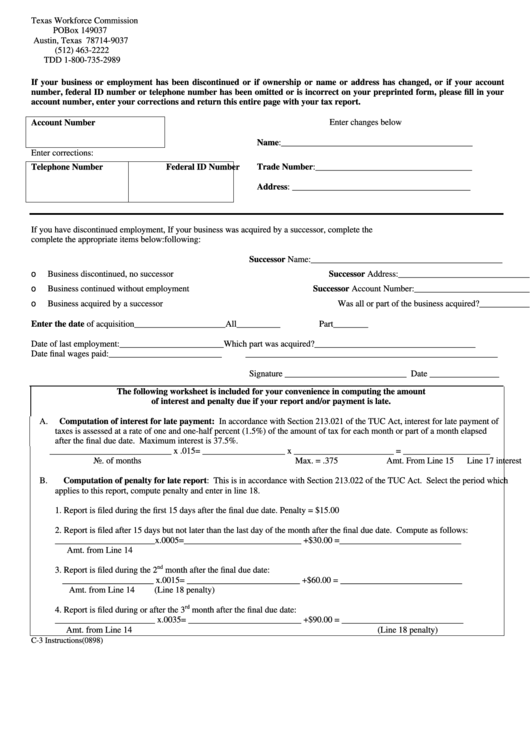

Form C3 Employer'S Quarterly Report Texas Workforce Commission

C3 form Fill out & sign online DocHub

Form C3 Employer'S Quarterly Report Instructions printable pdf download

TX CR3 20182022 Fill and Sign Printable Template Online US Legal

Form C3 Employer'S Quarterly Report printable pdf download

Form C3 Employer'S Quarterly Report Texas Workforce Commission

501c3 Form Sample Form Resume Examples jP8JDy5KVd

Tax Form 1040 For 2023 Printable Forms Free Online

Fillable Online texas tax id number Fax Email Print pdfFiller

You Will Need To Download And.

If You Need Additional Continuation.

A Federal Tax Exemption Only Applies To The Specific Organization To Which It Is Granted.

It Will Be Easier Than Ever For Parents To Opt Their Children Out Of Public School Vaccine Requirements Under A Bill Given Initial Passage In The Texas House Late Tuesday.

Related Post: