Va Form 502

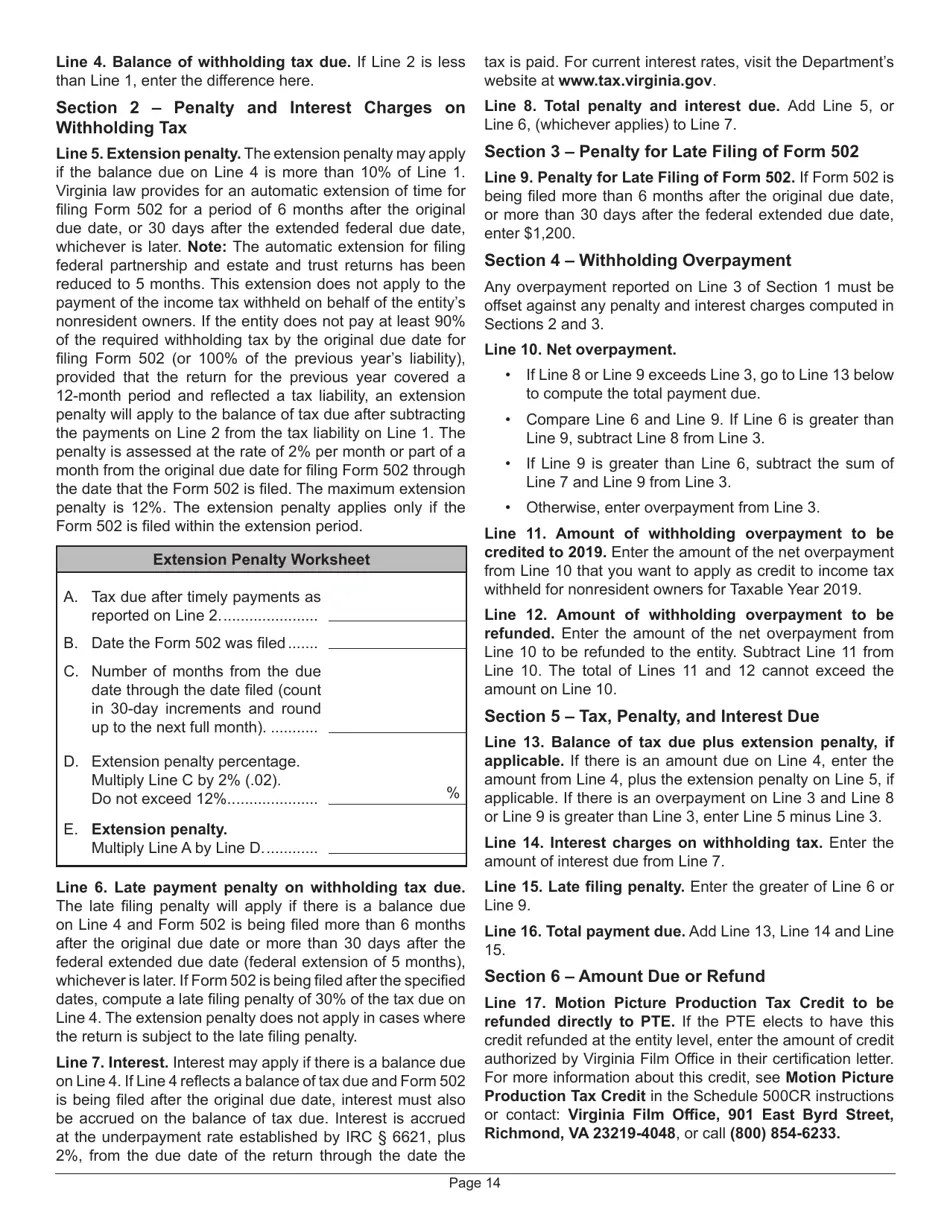

Va Form 502 - If form 502 is being filed more than 6 months after the original due date, or more than 30 days after the federal extended due date, enter $1,200. This federal/state program allows virginia to use irs. The letters and filing instructions will default to displaying the website for payment. If the pte’s income is all from virginia, then the entity does not allocate and apportion income; It includes filing requirements, penalties, and important information for both residents and. It details requirements for nonresident withholding tax and compliance. The virginia apportionment percentage is 100%, and schedule 502a is not required. To ensure this corporation is eligible to file form 502ez, please check the boxes below: A pte may make an annual election on its timely filed form 502ptet for taxable years beginning on or after january 1, 2022, but before january 1, 2026. Forms 502v (tax payment voucher) and 502w (withholding tax voucher) have been removed from the system. I certify that 100 percent of the. The election must be made on or. It includes filing requirements, penalties, and important information for both residents and. Forms 502v (tax payment voucher) and 502w (withholding tax voucher) have been removed from the system. To ensure this corporation is eligible to file form 502ez, please check the boxes below: It details requirements for nonresident withholding tax and compliance. A pte may make an annual election on its timely filed form 502ptet for taxable years beginning on or after january 1, 2022, but before january 1, 2026. If form 502 is being filed more than 6 months after the original due date, or more than 30 days after the federal extended due date, enter $1,200. The letters and filing instructions will default to displaying the website for payment. The virginia apportionment percentage is 100%, and schedule 502a is not required. To ensure this corporation is eligible to file form 502ez, please check the boxes below: It includes filing requirements, penalties, and important information for both residents and. You must meet all required conditions to be able to file form 502ez. The letters and filing instructions will default to displaying the website for payment. If form 502 is being filed more. It includes filing requirements, penalties, and important information for both residents and. If form 502 is being filed more than 6 months after the original due date, or more than 30 days after the federal extended due date, enter $1,200. Virginia partnership returns are prepared for calendar, fiscal, and short year partnerships using entries from the federal return, and on. To ensure this corporation is eligible to file form 502ez, please check the boxes below: Most companies use one suffix (001), and some companies file for multiple suffixes (001, 002, 003, etc.). You must meet all required conditions to be able to file form 502ez. If form 502 is being filed more than 6 months after the original due date,. The letters and filing instructions will default to displaying the website for payment. If form 502 is being filed more than 6 months after the original due date, or more than 30 days after the federal extended due date, enter $1,200. If the pte’s income is all from virginia, then the entity does not allocate and apportion income; I certify. It details requirements for nonresident withholding tax and compliance. To determine if you are required to file a virginia income tax return, consult a tax professional. Find out the requirements, methods, allocations, credits, and penalties for. To ensure this corporation is eligible to file form 502ez, please check the boxes below: Forms 502v (tax payment voucher) and 502w (withholding tax. A pte may make an annual election on its timely filed form 502ptet for taxable years beginning on or after january 1, 2022, but before january 1, 2026. It details requirements for nonresident withholding tax and compliance. Forms 502v (tax payment voucher) and 502w (withholding tax voucher) have been removed from the system. Find out the requirements, methods, allocations, credits,. To ensure this corporation is eligible to file form 502ez, please check the boxes below: You must meet all required conditions to be able to file form 502ez. The election must be made on or. A pte may make an annual election on its timely filed form 502ptet for taxable years beginning on or after january 1, 2022, but before. The letters and filing instructions will default to displaying the website for payment. Information and forms may be obtained at www.tax.virginia.gov, or by calling the department. To determine if you are required to file a virginia income tax return, consult a tax professional. It includes filing requirements, penalties, and important information for both residents and. If the pte’s income is. The virginia apportionment percentage is 100%, and schedule 502a is not required. To determine if you are required to file a virginia income tax return, consult a tax professional. Virginia partnership returns are prepared for calendar, fiscal, and short year partnerships using entries from the federal return, and on the virginia worksheets. The letters and filing instructions will default to. A pte may make an annual election on its timely filed form 502ptet for taxable years beginning on or after january 1, 2022, but before january 1, 2026. Forms 502v (tax payment voucher) and 502w (withholding tax voucher) have been removed from the system. Information and forms may be obtained at www.tax.virginia.gov, or by calling the department. I certify that. It details requirements for nonresident withholding tax and compliance. Forms 502v (tax payment voucher) and 502w (withholding tax voucher) have been removed from the system. To ensure this corporation is eligible to file form 502ez, please check the boxes below: I certify that 100 percent of the. If the pte’s income is all from virginia, then the entity does not allocate and apportion income; If form 502 is being filed more than 6 months after the original due date, or more than 30 days after the federal extended due date, enter $1,200. The virginia apportionment percentage is 100%, and schedule 502a is not required. The election must be made on or. The letters and filing instructions will default to displaying the website for payment. Information and forms may be obtained at www.tax.virginia.gov, or by calling the department. Virginia partnership returns are prepared for calendar, fiscal, and short year partnerships using entries from the federal return, and on the virginia worksheets. It includes filing requirements, penalties, and important information for both residents and. Most companies use one suffix (001), and some companies file for multiple suffixes (001, 002, 003, etc.). This federal/state program allows virginia to use irs.Top 11 Virginia Form 502 Templates free to download in PDF format

Top 11 Virginia Form 502 Templates free to download in PDF format

Form 502 Schedule SVK1 2022 Fill Out, Sign Online and Download

Download Instructions for Form 502 Virginia PassThrough Entity Return

Fillable Online 2021 Form 502 Instructions, Virginia PassThrough

Download Instructions for Form 502 Virginia PassThrough Entity Return

Form 1095A 20242025 Fill, Edit, and Download PDF Guru

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

Download Instructions for Form 502 Virginia PassThrough Entity Return

Va Form 502 Instructions 2022 Complete with ease airSlate SignNow

To Determine If You Are Required To File A Virginia Income Tax Return, Consult A Tax Professional.

A Pte May Make An Annual Election On Its Timely Filed Form 502Ptet For Taxable Years Beginning On Or After January 1, 2022, But Before January 1, 2026.

Find Out The Requirements, Methods, Allocations, Credits, And Penalties For.

You Must Meet All Required Conditions To Be Able To File Form 502Ez.

Related Post: