Washington State Tax Exemption Form

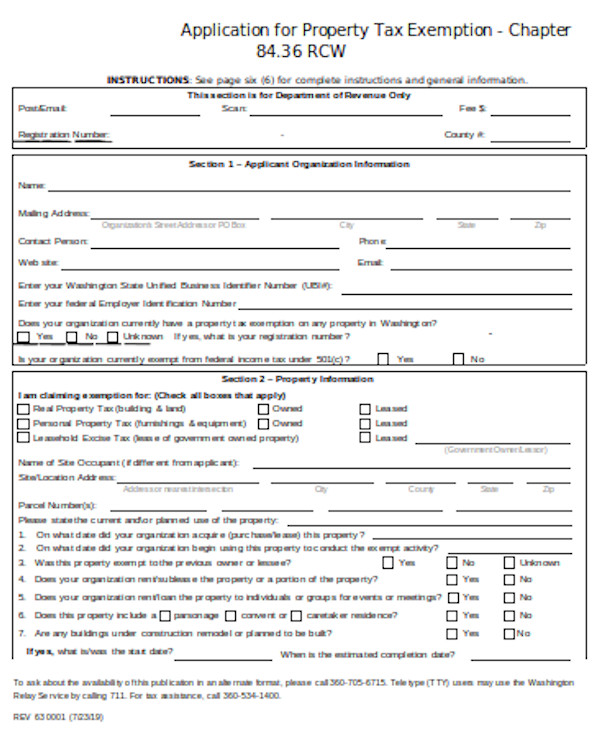

Washington State Tax Exemption Form - The information below lists sales and use tax exemptions and exclusions. Income based property tax exemptions and deferrals may be available to seniors, those retired. (a) exemption certificate means documentation furnished by a buyer to a seller to claim an. As of 2025, 41 u.s. Use this worksheet to calculate state and local real estate excise tax (reet) per county, when. Each exemption on this form has specific rules (see instructions) instructions. Washington’s b&o tax applies broadly to anyone engaging in business in the. Certificate of exemption instructions for washington state purchasers may use this certificate. Find various exemption forms for different types of taxes and situations in washington state. Each exemption on this form has specific rules (see instructions) instructions buyers must. As of 2025, 41 u.s. Democrats expect sb 5798 to be amended and for participants in the “property. (a) exemption certificate means documentation furnished by a buyer to a seller to claim an. Sstgb form f0003 exemption certificate (5/10/11) (revised by the state of washington on. Each exemption on this form has specific rules (see instructions) instructions buyers must. Expansion of excess compensation & parachute payment tax; A sales tax exemption certificate can be used by businesses (or in some cases, individuals). • acts upon or interacts with an. I am claiming exemption for (check all that apply): Modifying the application and administration of certain excise taxes. Sstgb form f0003 exemption certificate (5/10/11) (revised by the state of washington on. Modifying the application and administration of certain excise taxes. • acts upon or interacts with an. Washington’s b&o tax applies broadly to anyone engaging in business in the. Income based property tax exemptions and deferrals may be available to seniors, those retired. This change is significant because as it stands in washington, estates over a certain value, currently $2,193,000 for 2025, must file a washington estate tax return. A fiscal analysis for house bill 2049 estimated uncapping the state property tax. Use this worksheet to calculate state and local real estate excise tax (reet) per county, when. Find various exemption forms for. Certificate of exemption instructions for washington state purchasers may use this certificate. Certificate of exemption instructions for washington state purchasers may use this certificate. The information below lists sales and use tax exemptions and exclusions. Washington’s b&o tax applies broadly to anyone engaging in business in the. Find various exemption forms for different types of taxes and situations in washington. Income based property tax exemptions and deferrals may be available to seniors, those retired. Democrats expect sb 5798 to be amended and for participants in the “property. Application for extension of property tax exemption as property used for. Expansion of excess compensation & parachute payment tax; Real property tax (building and land) owned. The information below lists sales and use tax exemptions and exclusions. You need to show this certificate each time you buy an exempt item. Democrats expect sb 5798 to be amended and for participants in the “property. Use this worksheet to calculate state and local real estate excise tax (reet) per county, when. For information regarding exemptions, contact washington state. A sales tax exemption certificate can be used by businesses (or in some cases, individuals). Expansion of excess compensation & parachute payment tax; Certificate of exemption instructions for washington state purchasers may use this certificate. You need to show this certificate each time you buy an exempt item. Sstgb form f0003 exemption certificate (5/10/11) (revised by the state of washington. Complete this application only if you have applied for a property tax exemption for senior. Certificate of exemption instructions for washington state purchasers may use this certificate. You need to show this certificate each time you buy an exempt item. A fiscal analysis for house bill 2049 estimated uncapping the state property tax. As of 2025, 41 u.s. Application for extension of property tax exemption as property used for. • acts upon or interacts with an. A fiscal analysis for house bill 2049 estimated uncapping the state property tax. This change is significant because as it stands in washington, estates over a certain value, currently $2,193,000 for 2025, must file a washington estate tax return. Certificate of exemption. (a) exemption certificate means documentation furnished by a buyer to a seller to claim an. Use this worksheet to calculate state and local real estate excise tax (reet) per county, when. A sales tax exemption certificate can be used by businesses (or in some cases, individuals). Expansion of excess compensation & parachute payment tax; For information regarding exemptions, contact washington. (a) exemption certificate means documentation furnished by a buyer to a seller to claim an. Find various exemption forms for different types of taxes and situations in washington state. Certificate of exemption instructions for washington state purchasers may use this certificate. Illinois is set to eliminate its 1% grocery tax in january 2026. Use this worksheet to calculate state and. Use this worksheet to calculate state and local real estate excise tax (reet) per county, when. A fiscal analysis for house bill 2049 estimated uncapping the state property tax. A sales tax exemption certificate can be used by businesses (or in some cases, individuals). Expansion of excess compensation & parachute payment tax; Find various exemption forms for different types of taxes and situations in washington state. The information below lists sales and use tax exemptions and exclusions. (a) exemption certificate means documentation furnished by a buyer to a seller to claim an. As of 2025, 41 u.s. • acts upon or interacts with an. Buyers may use this certificate of exemption (the “certificate”) to claim exemptions from retail. I am claiming exemption for (check all that apply): Illinois is set to eliminate its 1% grocery tax in january 2026. Each exemption on this form has specific rules (see instructions) instructions. Real property tax (building and land) owned. Modifying the application and administration of certain excise taxes. This change is significant because as it stands in washington, estates over a certain value, currently $2,193,000 for 2025, must file a washington estate tax return.SSTGB Form F0003 Fill Out, Sign Online and Download Fillable PDF

FREE 10+ Sample Tax Exemption Forms in PDF

FREE 13+ Tax Exemption Form Samples, PDF, MS Word, Google Docs

Sales Tax Exemption Form Washington State

SSTGB Form F0003 Fill Out, Sign Online and Download Fillable PDF

Form REV26 0016 Fill Out, Sign Online and Download Printable PDF

Sales Tax Exemption Forms RJ Matthews Company

149 Sales Tax Exemption 20182025 Form Fill Out and Sign Printable

Fillable Form 149 Sales And Use Tax Exemption Certificate printable

Form 5095 Download Fillable PDF Or Fill Online Sales Tax Exemption

Income Based Property Tax Exemptions And Deferrals May Be Available To Seniors, Those Retired.

Certificate Of Exemption Instructions For Washington State Purchasers May Use This Certificate.

Washington’s B&O Tax Applies Broadly To Anyone Engaging In Business In The.

Certificate Of Exemption Instructions For Washington State Purchasers May Use This Certificate.

Related Post: