What Is A Form 720 Used For

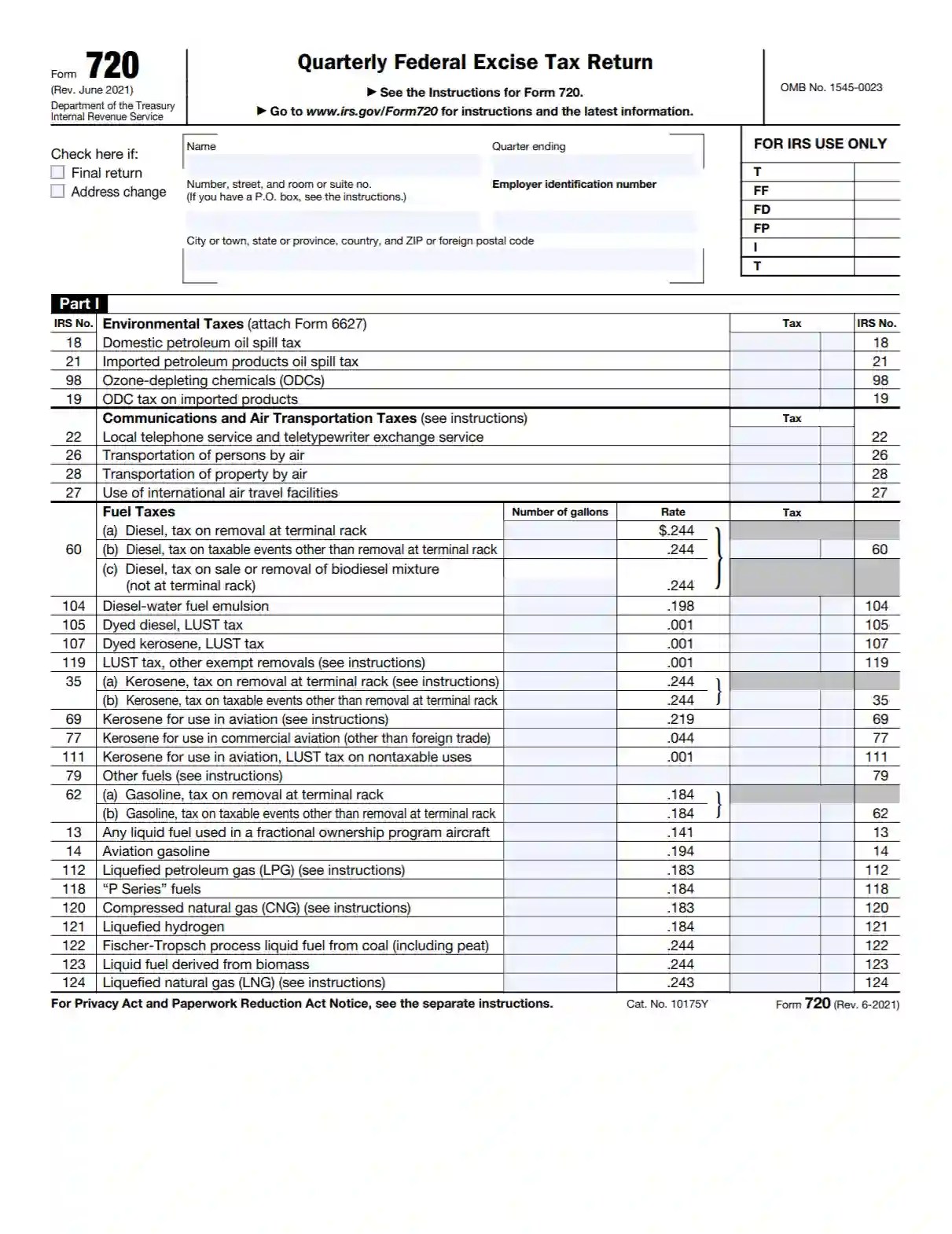

What Is A Form 720 Used For - Irs form 720, officially titled the quarterly federal excise tax return, is a. You can electronically file form 720 through any electronic return originator (ero), transmitter,. Irs form 720 is used to report and pay federal excise taxes on specific goods,. Form 720, or the quarterly federal excise tax return, is used to calculate and. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. Irs form 720 is known as the quarterly federal excise tax return. Who is required to file irs form 720?. When it comes to income tax filing, form 16 is one of the most important. Form 720, officially titled quarterly federal excise tax return, is a tax form used to report. Form 720 is used for the irs’s way of tracking and collecting excise taxes from companies that. What is irs form 720? Irs form 720 is known as the quarterly federal excise tax return. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. Form 720 is used for the irs’s way of tracking and collecting excise taxes from companies that. What is irs form 720? When it comes to income tax filing, form 16 is one of the most important. You can electronically file form 720 through any electronic return originator (ero), transmitter,. Form 720, officially titled quarterly federal excise tax return, is a tax form used to report. Form 720, or the quarterly federal excise tax return, is used to calculate and. Use form 720 and attachments to report your liability by irs no. Irs form 720, officially titled the quarterly federal excise tax return, is a. Irs form 720 is known as the quarterly federal excise tax return. What is irs form 720? Use form 720 and attachments to report your liability by irs no. The form is the information reporting return for taxpayers. Irs form 720 is used to report and pay federal excise taxes on specific goods,. Irs form 720 is known as the quarterly federal excise tax return. Use form 720 and attachments to report your liability by irs no. What is irs form 720? Irs form 720, officially titled the quarterly federal excise tax return, is a. What is irs form 720? When it comes to income tax filing, form 16 is one of the most important. Use form 720 and attachments to report your liability by irs no. Irs form 720 is used to report and pay federal excise taxes on specific goods,. The form is the information reporting return for taxpayers. Irs form 720 is used to report and pay federal excise taxes on specific goods,. The irs form 720 is used by businesses to file a quarterly federal. What is irs form 720? Form 720, officially titled quarterly federal excise tax return, is a tax form used to report. Who is required to file irs form 720?. When it comes to income tax filing, form 16 is one of the most important. Form 720 is used for the irs’s way of tracking and collecting excise taxes from companies that. Use form 720 and attachments to report your liability by irs no. Irs form 720 is used to report and pay federal excise taxes on specific goods,. What. Form 720, or the quarterly federal excise tax return, is used to calculate and. Irs form 720, officially titled the quarterly federal excise tax return, is a. The form is the information reporting return for taxpayers. Form 720 is used for the irs’s way of tracking and collecting excise taxes from companies that. The irs form 720 is used by. This guide explains what form 720 is, who needs to file it, how to complete it,. You can electronically file form 720 through any electronic return originator (ero), transmitter,. Irs form 720 is used to report and pay federal excise taxes on specific goods,. Who is required to file irs form 720?. Form 720, officially titled quarterly federal excise tax. Irs form 720 is known as the quarterly federal excise tax return. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. Irs form 720, officially titled the quarterly federal excise tax return, is a. Form 720 is used for the irs’s way of tracking and collecting excise. Form 720, also known as the “quarterly federal excise tax return,” is a tax form used in the. Use form 720 and attachments to report your liability by irs no. Irs form 720 is known as the quarterly federal excise tax return. What is irs form 720? Irs form 720 is used to report and pay federal excise taxes on. Form 720, also known as the “quarterly federal excise tax return,” is a tax form used in the. Form 720 is used for the irs’s way of tracking and collecting excise taxes from companies that. Who is required to file irs form 720?. Irs form 720 is known as the quarterly federal excise tax return. Form 720 is used by. The form is the information reporting return for taxpayers. Irs form 720 is used to report and pay federal excise taxes on specific goods,. You can electronically file form 720 through any electronic return originator (ero), transmitter,. The irs form 720 is used by businesses to file a quarterly federal. Irs form 720, officially titled the quarterly federal excise tax return, is a. Irs form 720 is known as the quarterly federal excise tax return. Form 720 is used for the irs’s way of tracking and collecting excise taxes from companies that. Information about form 720, quarterly federal excise tax return, including. Form 720, or the quarterly federal excise tax return, is used to calculate and. When it comes to income tax filing, form 16 is one of the most important. Use form 720 and attachments to report your liability by irs no. Form 720, also known as the “quarterly federal excise tax return,” is a tax form used in the. Who is required to file irs form 720?. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form.What is IRS Form 720? (Guidelines) Expat US Tax

Does My Business Need to File Form 720? A Complete Guide

What Is IRS Form 720? S'witty Kiwi

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

How to complete IRS Form 720 for the PatientCentered Research

What is IRS Form 720?

Form 720 Quarterly Federal Excise Tax Return

How to Complete Form 720 Quarterly Federal Excise Tax Return

Form 720 Quarterly Federal Excise Tax Return

IRS Form 720 ≡ Fill Out Quarterly Federal Excise Tax Return

What Is Irs Form 720?

Form 720, Officially Titled Quarterly Federal Excise Tax Return, Is A Tax Form Used To Report.

This Guide Explains What Form 720 Is, Who Needs To File It, How To Complete It,.

What Is Irs Form 720?

Related Post: