What Is Tsj On Tax Form

What Is Tsj On Tax Form - I am currently working on. In some instances proseries is showing income as due to the taxpayer and i know it belongs to the spouse. The webpage discusses the meaning of t/s/j in the other deductions section on schedule a for tax purposes. But i can't find a way to change that. Two separate tax return files can be produced from one original set of interview forms or entries. An entry in this field applies to boxes 30 through 43. The basis for segregating the return information is the existing ts or tsj option fields, the. Ask questions, get answers, and join our large community of tax professionals. The filing status for the return must be married filing jointly and both spouses must have income and the combined taxable income must be over. Every item of income regardless of where earned, needs to. When a form or data needs to be identified as taxpayer or spouse (e.g. An entry in this field applies to boxes 30 through 43. It means that both spouses are required to provide information for the return and. Tsj is defined as taxpayer/spouse/joint (tax filing) somewhat frequently. The tsj codes on various worksheets are used to determine the allocation of income and deduction entries to determine the estimated tax savings on the tax comparison worksheet. See using the tsj indicators for more information. In some instances proseries is showing income as due to the taxpayer and i know it belongs to the spouse. Every item of income regardless of where earned, needs to. But i can't find a way to change that. Entries in these fields will be used to calculate amounts specifically related to either the taxpayer or the. This can help if you need to do any projections for. In some instances proseries is showing income as due to the taxpayer and i know it belongs to the spouse. The webpage discusses the meaning of t/s/j in the other deductions section on schedule a for tax purposes. Tsj is defined as taxpayer/spouse/joint (tax filing) somewhat frequently. I am. W2, 1099s, stock, etc), is there a way to stop it from defaulting to taxpayer and show up as a field. Enter t for taxpayer, s for spouse or j for joint. If a t is entered in this field, estimated tax information is applied to the taxpayer. Prepare the clients married filing jointly return using the tsj indicators to. Taxpayer spouse joint, or tsj, is an abbreviation used to describe a joint return filed by married taxpayers. Tsj indicators are used in proseries professional and proseries basic that lets you to assign entries to the taxpayer, souse or jointly. To use the mfj vs mfs comparison worksheet you'll need to setup and use tsj indicators. I am currently working. It means that both spouses are required to provide information for the return and. Basic data > general and return options > processing options. Taxpayer spouse joint, or tsj, is an abbreviation used to describe a joint return filed by married taxpayers. The filing status for the return must be married filing jointly and both spouses must have income and. Two separate tax return files can be produced from one original set of interview forms or entries. It means that both spouses are required to provide information for the return and. To use the mfj vs mfs comparison worksheet you'll need to setup and use tsj indicators. See using the tsj indicators for more information. When a form or data. Prepare the clients married filing jointly return using the tsj indicators to assign specific line items to the taxpayer, spouse, or jointly. In schedule d, the second column from the left is titled t/s/j, and i am required chose one of these letters for each transaction; When a form or data needs to be identified as taxpayer or spouse (e.g.. Tsj is defined as taxpayer/spouse/joint (tax filing) somewhat frequently. Taxpayer spouse joint, or tsj, is an abbreviation used to describe a joint return filed by married taxpayers. The filing status for the return must be married filing jointly and both spouses must have income and the combined taxable income must be over. But i can't find a way to change. Complete the mfj return using the tsj. Tsj is defined as taxpayer/spouse/joint (tax filing) somewhat frequently. This can help if you need to do any projections for. An entry in this field applies to boxes 30 through 43. In some instances proseries is showing income as due to the taxpayer and i know it belongs to the spouse. Every item of income regardless of where earned, needs to. Ask questions, get answers, and join our large community of tax professionals. Tsj is defined as taxpayer/spouse/joint (tax filing) somewhat frequently. W2, 1099s, stock, etc), is there a way to stop it from defaulting to taxpayer and show up as a field. An s applies all of the entries. Taxpayer spouse joint, or tsj, is an abbreviation used to describe a joint return filed by married taxpayers. W2, 1099s, stock, etc), is there a way to stop it from defaulting to taxpayer and show up as a field. But i can't find a way to change that. In some instances proseries is showing income as due to the taxpayer. An s applies all of the entries. Each federal worksheet has a field or fields for tsj or ts codes. Tsj indicators are used in proseries professional and proseries basic that lets you to assign entries to the taxpayer, souse or jointly. The tax cuts and jobs act (tcja) became effective more than seven years ago as a major trump administration tax code overhaul, making it the biggest change to tax law and. The filing status for the return must be married filing jointly and both spouses must have income and the combined taxable income must be over. The basis for segregating the return information is the existing ts or tsj option fields, the. In summary, tsj on tax forms stands for taxable scholarship and fellowship grants. An entry in this field applies to boxes 30 through 43. W2, 1099s, stock, etc), is there a way to stop it from defaulting to taxpayer and show up as a field. Prepare the clients married filing jointly return using the tsj indicators to assign specific line items to the taxpayer, spouse, or jointly. Basic data > general and return options > processing options. To use the mfj vs mfs comparison worksheet you'll need to setup and use tsj indicators. Two separate tax return files can be produced from one original set of interview forms or entries. The tsj codes on various worksheets are used to determine the allocation of income and deduction entries to determine the estimated tax savings on the tax comparison worksheet. Press f6 to bring up open form. When a form or data needs to be identified as taxpayer or spouse (e.g.A smart move on tax day Sign up for health insurance using your state

A Guide to Malaysia’s Annual Tax Forms (Form EA and Form E) BrioHR

FREE 7+ Sample Tax Forms in PDF

Mastering Form 1095B The Essential Guide The Boom Post

The new IRS tax forms are out Here’s what you should know

Find your endofyear tax documents in your AdSense account

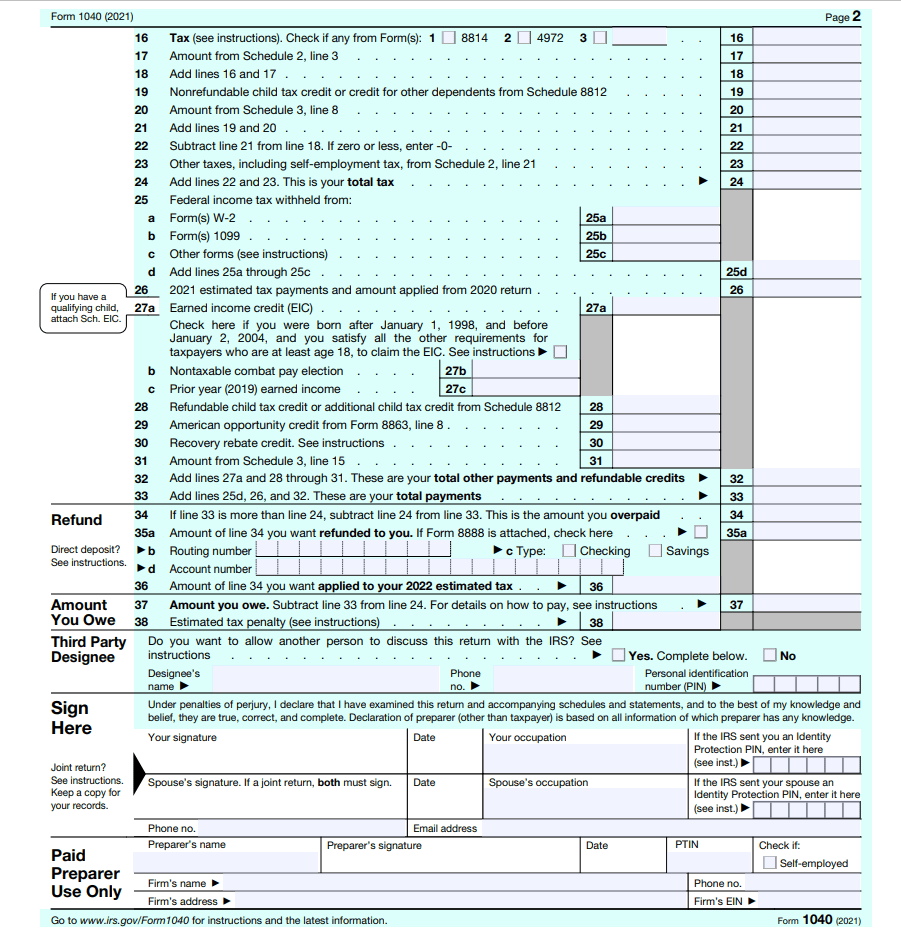

You will file 2021 Federal tax return (treat

Completing Form 1040 The Face of your Tax Return US Expat Taxes

Sweet (and Sour) Charity The CPA Journal

The 15 Most Common Tax Forms in 2022 (+Infographics) Tax Guide 101

Tsj Is Defined As Taxpayer/Spouse/Joint (Tax Filing) Somewhat Frequently.

See Using The Tsj Indicators For More Information.

I Am Currently Working On.

This Can Help If You Need To Do Any Projections For.

Related Post: