Civpen Form Irs

Civpen Form Irs - The assessment of a civil penalty on a specific tax module when taxpayer behavior fails to meet prescribed tax obligations (see irm 20.1.1.2). They help to determine a taxpayer’s reasonable collection potential (rcp). An irs civil penalty is a punishment that the internal revenue service (irs) can impose on taxpayers for various reasons. Mail form 4868 by the tax deadline. What this means is that the irs is making you pay a civil penalty for doing something wrong. It does not apply to the employer’s share of social security and medicare taxes. It is not a form. Learn more about how to file electronically. The irs will charge a penalty if you do not pay at least 90%. The irs has the power to levy civil penalties for a. Mail form 4868 by the tax deadline. Did you perhaps get a notice from the irs with civpen listed as the tax form? Filing online can help you avoid mistakes and find credits and deductions for which you may qualify. They help to determine a taxpayer’s reasonable collection potential (rcp). If you do not pay the amount due immediately, the irs will seize (levy) certain property or rights to property and apply it to pay the amount you owe. The assessment of a civil penalty on a specific tax module when taxpayer behavior fails to meet prescribed tax obligations (see irm 20.1.1.2). The irs will charge a penalty if you do not pay at least 90%. You have an unpaid amount due on your account. If the payroll taxes are left unpaid and you close your business, then the irs can assess a civ pen (civil penalty) against the owners of the business and collect from your personal assets. Prior to being assessed to the responsible individual(s) of the delinquent business, this tax is often referred to simply as the trust fund. It does not apply to the employer’s share of social security and medicare taxes. Internal revenue code section 6672 authorizes the irs to assess and to collect personally from the “responsible person” when employment taxes are not paid over to the irs. Typically, if such a levy is placed on your bank account by the irs then you should also. The assessment of a civil penalty on a specific tax module when taxpayer behavior fails to meet prescribed tax obligations (see irm 20.1.1.2). Six of the most common small business civil tax penalties are: If you do not pay the amount due immediately, the irs will seize (levy) certain property or rights to property and apply it to pay the. They help to determine a taxpayer’s reasonable collection potential (rcp). Prior to being assessed to the responsible individual(s) of the delinquent business, this tax is often referred to simply as the trust fund. Mail form 4868 by the tax deadline. To request penalty abatement, you’ll need to submit form 843 to the irs along with a written explanation and any. If the payroll taxes are left unpaid and you close your business, then the irs can assess a civ pen (civil penalty) against the owners of the business and collect from your personal assets. But irs will list it as the form on notices. The irs has the power to levy civil penalties for a. It is not a form.. If the payroll taxes are left unpaid and you close your business, then the irs can assess a civ pen (civil penalty) against the owners of the business and collect from your personal assets. What this means is that the irs is making you pay a civil penalty for doing something wrong. The irs will charge a penalty if you. Mail form 4868 by the tax deadline. Reviewers are required to review. An irs civil penalty is a punishment that the internal revenue service (irs) can impose on taxpayers for various reasons. A civpen stands for civil penalty. To request penalty abatement, you’ll need to submit form 843 to the irs along with a written explanation and any supporting documentation. The irs has the power to levy civil penalties for a. Mail form 4868 by the tax deadline. Prior to being assessed to the responsible individual(s) of the delinquent business, this tax is often referred to simply as the trust fund. If so, this means civil penalty. What this means is that the irs is making you pay a civil. Did you perhaps get a notice from the irs with civpen listed as the tax form? You have an unpaid amount due on your account. The irs will charge a penalty if you do not pay at least 90%. Learn more about how to file electronically. The assessment of a civil penalty on a specific tax module when taxpayer behavior. But irs will list it as the form on notices. The assessment of a civil penalty on a specific tax module when taxpayer behavior fails to meet prescribed tax obligations (see irm 20.1.1.2). Internal revenue code section 6672 authorizes the irs to assess and to collect personally from the “responsible person” when employment taxes are not paid over to the. If so, this means civil penalty. Common civil penalties in tax. The irs will charge a penalty if you do not pay at least 90%. Did you perhaps get a notice from the irs with civpen listed as the tax form? They help to determine a taxpayer’s reasonable collection potential (rcp). If the payroll taxes are left unpaid and you close your business, then the irs can assess a civ pen (civil penalty) against the owners of the business and collect from your personal assets. They help to determine a taxpayer’s reasonable collection potential (rcp). Of course, the best way to handle a. Mail form 4868 by the tax deadline. It is not a form. The irs will charge a penalty if you do not pay at least 90%. What this means is that the irs is making you pay a civil penalty for doing something wrong. In many cases, you can file for free. Prior to being assessed to the responsible individual(s) of the delinquent business, this tax is often referred to simply as the trust fund. A civpen stands for civil penalty. Did you perhaps get a notice from the irs with civpen listed as the tax form? Internal revenue code section 6672 authorizes the irs to assess and to collect personally from the “responsible person” when employment taxes are not paid over to the irs. Common civil penalties in tax. An irs civil penalty is a punishment that the internal revenue service (irs) can impose on taxpayers for various reasons. If so, this means civil penalty. It does not apply to the employer’s share of social security and medicare taxes.Internal Revenue Bulletin 202413 Internal Revenue Service

2025 Irs Form 1040 Bailey Wickens S.

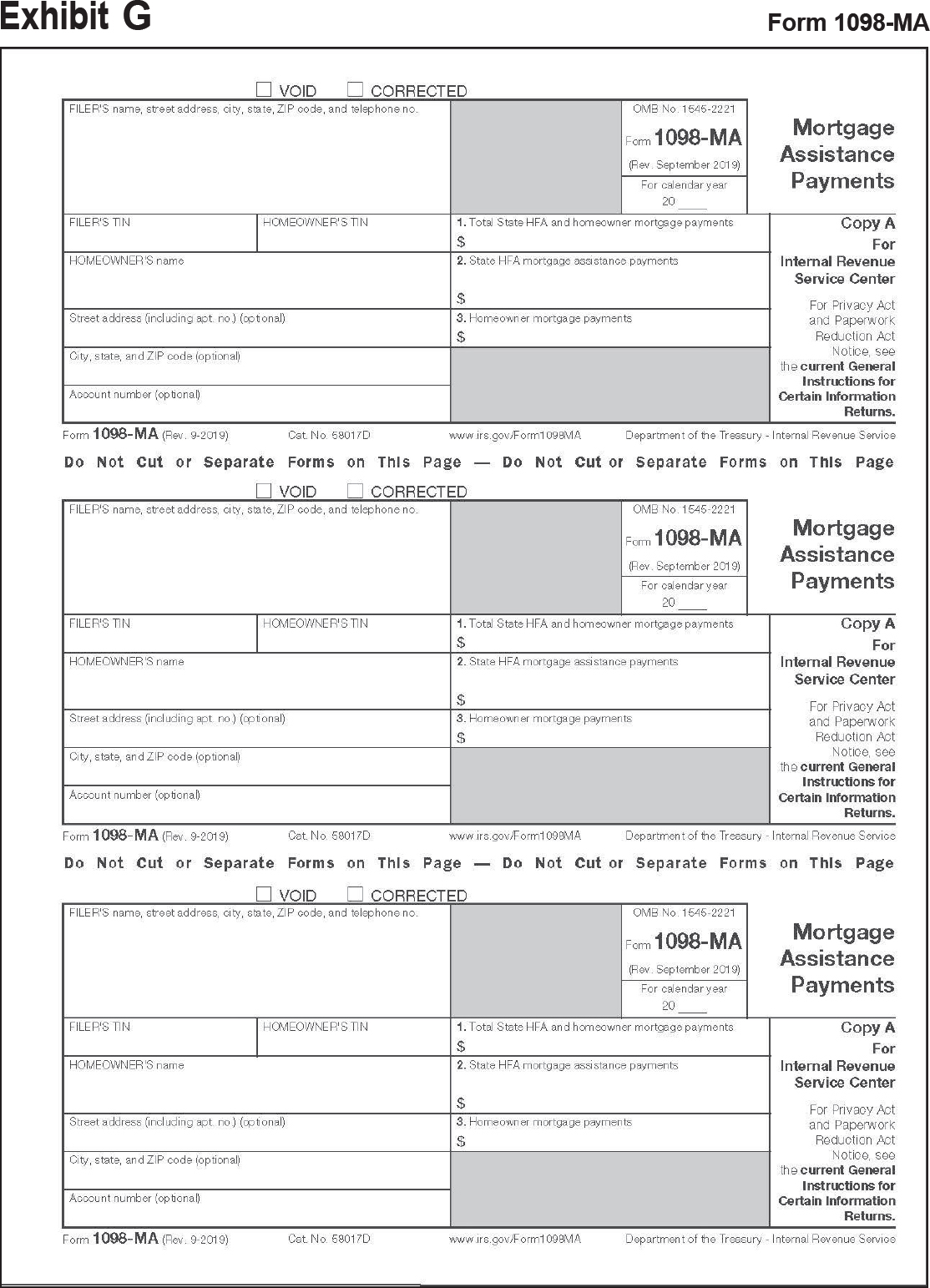

FREE 22+ Sample Tax Forms in PDF Excel MS Word

IRS Notice CP504 Notice of Intent to Seize Your Property H&R Block

Internal Revenue Bulletin 202413 Internal Revenue Service

2025 19 Form Sean Mackennal

Irs Forms 2024 Lishe Celestyna

Irs Form 1040 V 2023 Printable

Internal Revenue Bulletin 202413 Internal Revenue Service

IRS Form 8332 A Guide for Custodial Parents

But Irs Will List It As The Form On Notices.

You Have An Unpaid Amount Due On Your Account.

Learn More About How To File Electronically.

If You Do Not Pay The Amount Due Immediately, The Irs Will Seize (Levy) Certain Property Or Rights To Property And Apply It To Pay The Amount You Owe.

Related Post: